Asia’s easing economic headwinds make way for stronger recovery

BI Desk || BusinessInsider

Graphics: IMF Blog

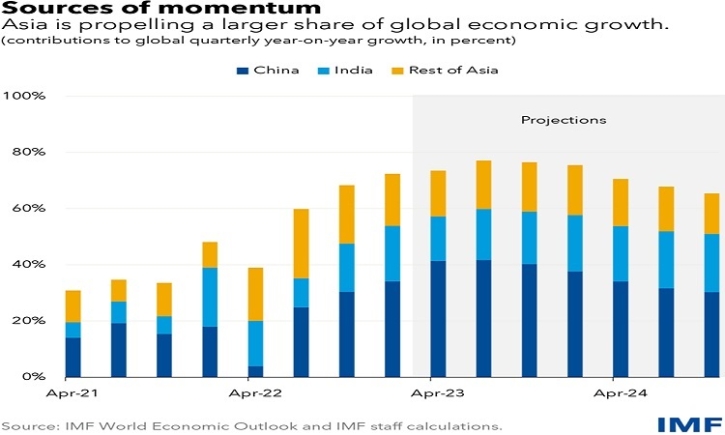

The economic headwinds that faced Asia and the Pacific last year have started to fade as the global financial conditions have eased, food and oil prices are down and China’s economy is rebounding.

These developments are helping improve prospects across the region, with growth set to accelerate to 4.7 percent this year from 3.8 percent in 2022.

This will make it by far the most dynamic of the world’s major regions and a bright spot in a slowing global economy.

The region’s emerging and developing economies, poised to expand by 5.3 percent this year, drive this dynamism.

These economies are hitting their stride as pandemic supply-chain disruptions fade and the service sector booms.

China and India alone are expected to contribute more than half of global growth this year, with the rest of Asia contributing an additional quarter.

Cambodia, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam are all back to their robust pre-pandemic growth.

The most significant revision since we last published forecasts in October has been to China, where a sudden re-opening has paved the way for a faster-than-expected rebound in activity.

China has strong trade and tourism linkages, so this is positive news for Asia, as half of the region’s trade takes place between its economies.

Our analysis in the latest Regional Economic Outlook for Asia and the Pacific shows that, for every percentage point of higher growth in China, output in the rest of Asia rises by around 0.3 percent.

While benefiting from these developments, prospects for Asia’s advanced economies are more mixed.

The near-term outlook for Japan is stronger, supported by accommodative policies, border reopening and supply chain improvements while growth would fall back in 2024 as conditions normalize and policy support eases.

The strong performance of manufacturing exports has also started to cool under the weight of slowing global trading partners.

For Korea, Singapore, and Taiwan Province of China, the technology cycle—visible in the sagging price of microchips—is a drag on exports that’s likely to last through year-end.

But with growth thought to be bottoming out in the rest of the world, external demand should firm heading into next year.

Easing inflation

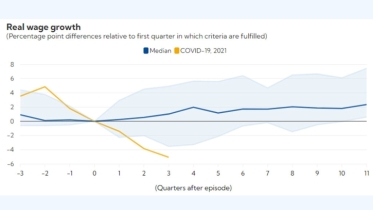

Asia’s inflation—which rose worryingly above central bank targets last year—is poised to moderate.

There are now encouraging signs that headline inflation peaked during the second half of last year, though core inflation is proving more persistent and has yet to ease definitively.

We expect inflation to return to central bank targets sometime next year amid an easing of financial and commodity headwinds.

Global financial conditions have eased somewhat, and with them the US dollar has lost some strength. Central banks in Asia have been hiking interest rates as they tackle above-target inflation.

These factors have helped Asian currencies rebound, with most erasing about half of last year’s losses, which has eased pressure on domestic prices.

Commodity prices soared following Russia’s invasion of Ukraine, squeezing Asia’s energy importers early last year.

At the same time, soaring shipping costs raised the cost of imported goods, with particularly strong impacts on the Pacific Island Countries.

But more recently, steady declines in both these factors have taken pressure off current accounts and inflation.

While inflation is moving in the right direction, central banks need to stay alert. Core inflation is still running above target.

The big supply shocks and permanent structural realignments associated with the pandemic have made calibrating monetary policy particularly challenging. Signals in the data about second-round effects are mixed, further heightening uncertainty for policy makers.

Given the two-sided risks to inflation in Japan, more flexibility in long-term yields would help to avoid abrupt changes later.

And finally, the renewed dynamism of the Chinese economy may put upward pressure on global commodity and service prices, particularly in countries expecting resurgent tourism.

This means that central banks should tread carefully by reaffirming their commitment to price stability.

Indeed, they may need to hike rates further if core inflation does not show clear signs of returning to target.

Elevated debt, financial risk

While the short-term outlook has brightened, important longer-term challenges remain.

Another important revision to the outlook for China is our downgrade of its medium-term prospects.

Just like the near-term acceleration in growth in China is expected to generate positive spillovers, the slowdown in coming years will weigh on growth prospects across Asia’s highly integrated supply chains and around the world.

This will make reforms to boost productivity and long-term growth more urgent across Asia.

Fiscal deficits during the pandemic and higher long-term interest rates over the past year added to public debt burdens.

With several Asian countries facing debt distress, authorities must continue with their plans for gradual fiscal consolidation. Doing so will also ensure that monetary and fiscal policies are not acting at cross purposes.

Finally, many Asian countries face elevated financial vulnerabilities, with high leverage across household and corporate sectors, and significant bank exposure to real estate downturns.

This suggests subtle policy trade-offs between controlling inflation and ensuring financial stability, and a need to strengthen resolution frameworks.