Wage-price spiral risks still contained, latest data suggests

IMF Blog || BusinessInsider

Photo: IMF Blog

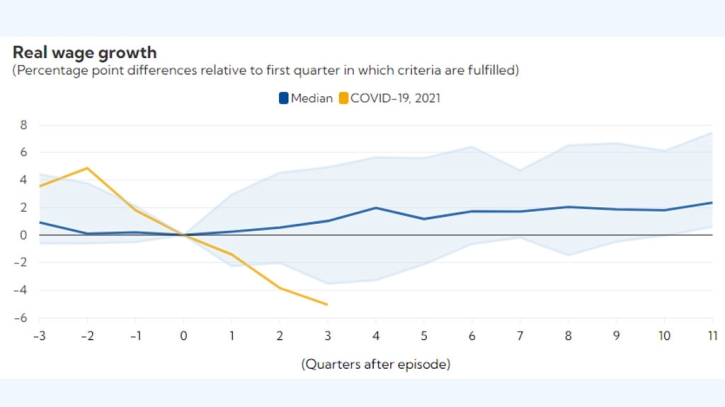

Persistent wage and price growth in the latest data may raise concern that wages and prices are feeding on each other and likely to accelerate over a sustained period, an outcome known as a wage-price spiral. If such a spiral emerges, the fear is that inflation would keep rising and expectations become unanchored.

However, in similar episodes from the past, this worry turned out to be unfounded, according to our earlier analysis highlighted in paper and chapter of the October 2022 World Economic Outlook Updating that analysis to include the latest data through the third quarter of last year, we still conclude that wage-price spiral risks remain contained.

In our study, we specifically looked for historical episodes similar to today for a rich set of advanced economies going back to the first quarter of 1960 for some and ending in the third quarter of last year.

As the Chart of the Week shows, only a few episodes with dynamics like those in advanced economies during the post-pandemic recovery were followed by wage-price spirals, defined as sustained periods of both price and nominal wage accelerations. In most cases, nominal wages caught up while inflation ticked down over several quarters, allowing inflation-adjusted wages to gradually recover. A sustained acceleration of wages and prices was rare.

When plotting recent wage and price inflation up to the third quarter of 2022 for the median economy in our sample, we see that even though inflation last year rose more than during the sample of past episodes, nominal wage growth has failed to keep up.

As a result, real wages have decreased in most advanced economies in our sample. Unemployment rates remained stable or fell in most countries, as labor demand picked up after the pandemic-induced pause. Tighter labor markets have coincided with nominal wage growth increases in most of the world. However, nominal wage growth has not been abnormally above what would be expected based on the historical experience.

Our conclusion is that wage-price spiral risks still appear contained. The historical evidence from past, similar episodes also points to what we might expect going forward: increases in nominal wage growth can happen alongside a deceleration in consumer prices, allowing real wages to start growing again. Monetary policy tightening followed most of the past episodes, which helped to keep inflation contained.

If this average historical pattern holds, we expect nominal wage growth may remain elevated or pick up even while inflation declines. This could recover some of the purchasing power lost last year. Importantly, history tells us that this expected recovery of real wage growth would not by itself signal the start of wage-price spiral.