Preventing multibank borrowing could reduce NPLs: Study

BIBM researchers come up with solutions to the NPL problem

BI Report || BusinessInsider

NPLs

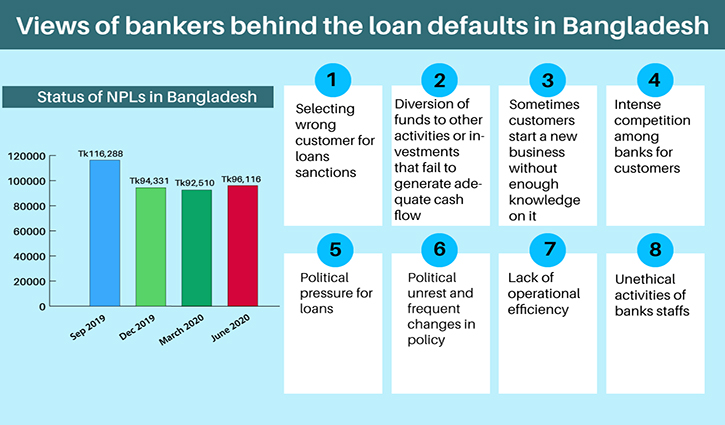

With the same borrower taking loans from many banks, the lending banks lose control over the borrower and the loan amount substantially exceeds repayment capacity, ultimately ending in default loans.

In order to prevent this situation, the Bangladesh Bank can frame a policy to stop the multibank borrower and thereby reduce non-performing loans (NPLs) to some extent.

Researchers came up with the suggestion in a paper titled NPL in Banks of Bangladesh: Macroeconomic and Bank Specific Perspective.

The findings of the study were revealed at an online seminar organised by the Bangladesh Institute of Bank Management (BIBM) on Wednesday. Dr Md Akhtaruzzaman, director general of BIBM, and SM Moniruzzaman, chairman of the BIBM Executive Committee and deputy governor of Bangladesh Bank, were present at the seminar.

BIBM Associate Professors Md Alamgir, Dr Mohammad Tazul Islam, Antara Zareen and Rahat Banu, and First Assistant Vice President of United Commercial Bank Ltd Md Ziaul Hasan were the researchers for this study.

They recommended the central bank to develop an information system integrated with that of all other banks. Lending banks can then access Bangladesh Bank’s integrated information system to know about bad debtors and only approve loans upon checking the sound credibility of the borrower.

NPLs can be reduced to a great extent by improving return on assets (ROA), the researchers said. Therefore, by introducing proper supervision, monitoring and follow-up action, management can get early warning signals about potential classified loans and can take proactive action, the paper suggested.

Another recommendation the researchers came up with is for banks to employ an agent in the borrower’s company, especially in case of large corporate borrowers, who will be responsible for monitoring whether the lent amount is properly being used for the approved project or not.

In this way, banks can monitor the borrowers on a regular basis after fund disbursement and may give early warnings if the businesses are getting worse. They can also give suggestions to the borrowers.

Smart borrowers, in most cases, try to outsmart the proper lending process of the banks and take the loans using undue influence, the study found. So, bank authorities should take concrete steps to prevent unethical activities of all staff connected with credit creation, sanction, documentation and disbursement.

Proper investigation and assessment of credit risk of the borrower is a must to make the loan performing and reduce the credit risk to a tolerable level.

The banks should also properly assess the value of assets provided by the borrower as security.

Sometimes, bankers try to sanction loans and advances to a new, inexperienced and non-tested borrower to meet their credit target. These excess loans could result in default as well.

Sound and effective corporate governance of banks will always help it reduce NPLs, the study said, adding that bank management should put good governance in place to ensure proper management of loans and advances.

The researchers also called for keeping banks free from political influence in selecting borrowers.

At the end of June this year, the amount of NPLs in the banking sector stood at Tk96,116 crore, which was 9.16% of the total disbursed loans, according to Bangladesh Bank data.

The defaulted loans in the banking sector were Tk92,510 crore as of March this year.

NPLs hit an all-time high at Tk116,288 crore at the end of September 2019, but the figure dropped to Tk94,331 crore as of December 31, 2019, owing to an easy loan rescheduling policy.