Nagad shakes up MFS market in 3 years, still long way to go

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

Despite the question about its legal relationship with the state-owned Bangladesh Post Office and for its fourth-time interim licence extension as mobile financial services (MFS) provider, it has played an outstanding role in transforming Bangladesh into a cashless society and financial inclusion.

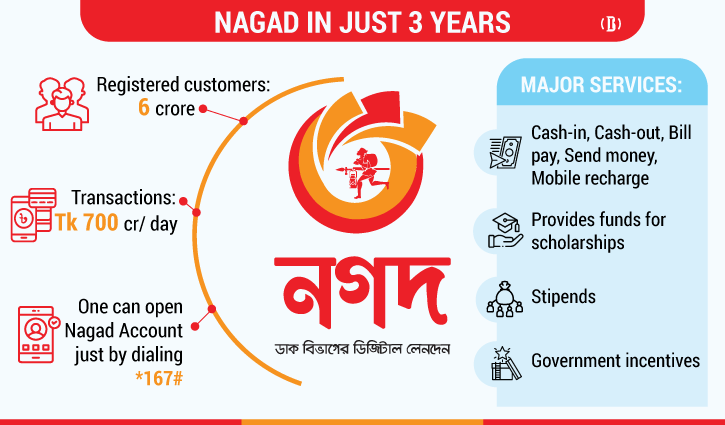

In just three years since its inception, the MFS company has bagged six crore customers and its daily transactions reach a whopping Tk 700 crore.

Most importantly, the company has played a key role to make the market competitive. Before Nagad came into the market, industry leader bKash used to charge Tk 18.5 at the customer level for cash-out for Tk 1,000.

But in October 2020 when the country was in the impact of the coronavirus pandemic, Nagad brought its cash-out charge to Tk 9.99 for Tk 1,000.

Later, other operators, including market leader bKash were forced to bring down the charges to remain strong in the industry. Last year bKash cut the cash-out charge to Tk 14.90 per Tk 1,000, for cash-out up to Tk 25,000 per month through selected agents.

Also, Nagad has emerged as the close competitor of market leader bKash that began business a decade ago.

Presently, Nagad has six crore registered customers, while leader bKash’s customers are also six crore. But in terms of monetary transactions using bKash are two and a half times higher than Nagad.

Other than cash-in and cash-out, Nagad provides services like bill pay, mobile recharge, EMI payment, bank to Nagad, etc.

Commenting on the anniversary of Nagad, Mustafa Jabbar, posts and telecommunications minister, said what Nagad has attained in three years will be a role model for others.

“Nagad is playing a vital role in making Bangladesh a paperless country and it will continue to attract customers through innovative services in the coming days,” Jabbar said.

Still, Nagad has to go a long way to achieve the full trust of customers.

Most importantly, it has to be a subsidiary of the government’s postal department if it wants to achieve a licence as an MFS provider from Bangladesh Bank. But it is not an easy task as the government has to amend two acts related to the postal department for making Nagad a subsidiary company.

Currently, Nagad says it is a service under the Bangladesh Post Office (BPO). Actually, BPO has no ownership in the company. Nagad shares revenue with the BPO on an annual basis.