Pubali Bank goes big with Islamic banking

BI Report || BusinessInsider

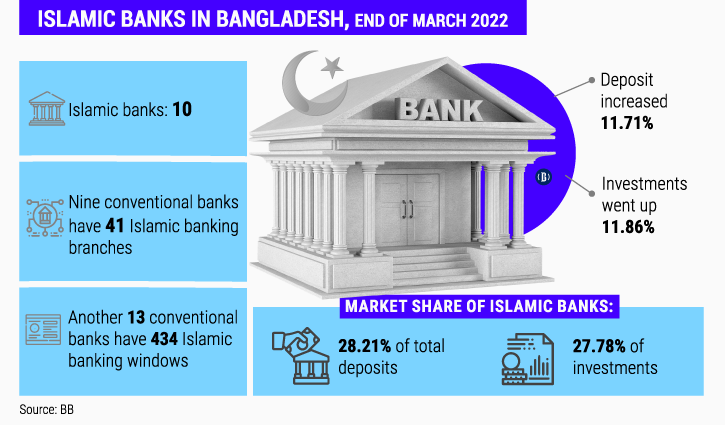

Infographic: Business Insider Bangladesh

Pubali Bank, which is the largest private bank in terms of branch network, has announced a massive expansion in its Islamic banking services in a bid to woo customers.

From now and on, the Shariah-based banking services will be available at all its 491 branches and 93 sub-branches across the country.

“We see a tendency that businesses and other clients want to avail Islamic banking services. So, why not use our huge network,” Safiul Alam Khan Chowdhury, managing director and CEO of the bank, told Business Insider Bangladesh.

“We want to use our huge resources of manpower and branch network to provide the Shariah-based banking services, which are in strong demand,” Chowdhury said.

Chowdhury, who opened the services as chief guest, said any client can get Islamic banking services from any branch of the bank.

Pubali Bank introduced Islamic banking products alongside conventional banking through two Islamic banking windows in 2010.

Later, 10 Islamic banking windows were opened in 2019 and five more in 2020 with the approval of the Bangladesh Bank. At present, the total number of Islamic banking windows in the bank is 17.

The bank in a statement on Monday said customers will get Islamic banking facilities from all branches and sub-branches. Under this, they can open, close and renew all types of deposit accounts. Clients can accept chequebooks from all branches and sub-branches and give any kind of banking instructions.

Mohammad Ali, additional managing director and chief operating officer (COO) of the bank was present as a special guest. Deputy Managing Director and Company Secretary Zahid Ahsan and General Manager of Islamic Banking Wing Dewan Jamil Masud were also present at the programme held at the bank’s headquarters.