Uniform exchange rates of dollar fixed

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

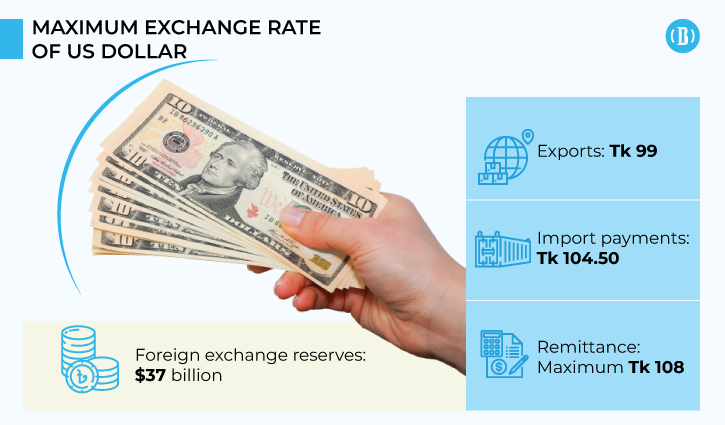

Banks will be able to quote a maximum Tk 108 for getting remittances from exchange houses and Tk 99 for procuring export proceeds.

On the other hand, the exchange rate for import payments has been set at a maximum Tk 104.50.

The Association of Bankers, Bangladesh (ABB) and the Bangladesh Foreign Exchange Dealers’ Association (BAFEDA) made the decision in a meeting held at the headquarters of the state-owned Sonali Bank.

Afzal Karim, managing director of Sonali Bank and chairman of BAFEDA, told reporters about the update on the rate fixation.

Selim RF Hussain, chairman of ABB and managing director of BRAC Bank, hoped the volatility in the exchange rate market will be stable after this agreement.

“But this rate will change from time to time,” he told reporters.

Earlier on Thursday, banks and foreign exchange dealers at a meeting with the central bank agreed to set a uniform exchange for the sake of the economy. As part of the move, they sat at a meeting on Sunday and agreed on the uniform rate.

Though Bangladesh Bank officially launched the floating exchange rate in 2003, it used to control the market by injecting the dollar or withdrawing it. Accordingly, the exchange rate of the dollar remained at Tk 85-86 in 2020 and 2021 despite a slump in demand due to the Covid-19 pandemic. The rate could have fallen below Tk 80 for a dollar if the central bank had not intervened, treasury bankers said.

The exchange rate market got volatile in 2022, first for the supply chain disruption globally and then the Russia-Ukraine war that pushed the prices of all commodities up. And, a country like Bangladesh which relies on imports for food, fuel oils, gas, and industrial raw materials has been forced to pay more for buying goods from the international markets.

Accordingly, the rising demand for the greenback has depreciated the local currency, which stands at Tk 95 in the interbank exchange rate, up from Tk 86.50 in the middle of April this year. When the exchange rate soared to Tk 110-112 for import payments, the central bank stepped in to cool down the market. The BB also ordered six banks to remove their treasury heads for manipulating the exchange rate.