Internet banking shines in pandemic

BI Special || BusinessInsider

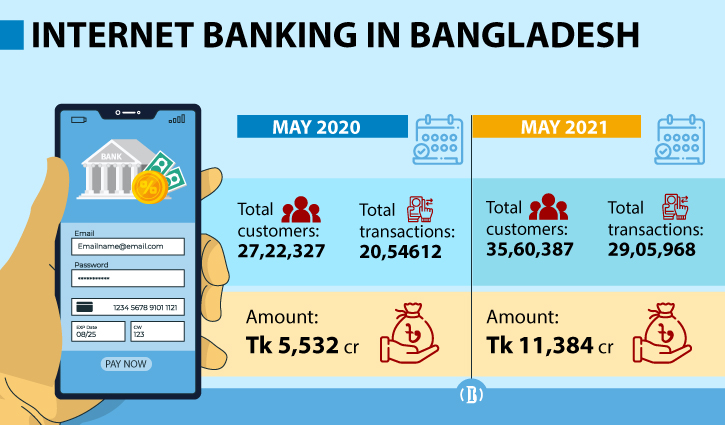

Popularity of internet banking rises sharp in Bangladesh amid Covid-19 pandemic. BI Infographics.

The ongoing Covid-19 pandemic has accelerated internet banking in Bangladesh as many customers avoid going to banks for transactions in a bid to limit exposure from the highly contagious virus.

According to Bangladesh Bank (BB) data, internet banking customers rose by nearly 31 percent to over 35.60 lakh year-on-year in May 2021. Number of transactions and transacted amounts also saw significant growth during the pandemic time.

In May last year, Tk 5,532 crore was transacted through internet banking and the amount got more than double to Tk 11,384 crore in May this year.

“Over 8,000 customers are being added to our internet banking per month. We are getting a huge response from customers for internet banking nowadays,” said Arup Haider, head of retail banking of City Bank, the market leader in this segment.

Per day average transaction through internet banking of City Bank reaches over 25,000 in 2021, up from average 14,000 in 2020 and 10,000 in 2019.

To make banking easier and convenient to the clients, City Bank launched City Touch, a digital banking app in 2013.

This digital banking app has not just made the bank’s existing customers more attached to the bank, it has also brought in many new customers, and many of them migrated from other banks.

“You can do almost all banking activities – from fund transfer to bill payments, loan application and many more services - by the City Touch,” Haider told the Business Insider Bangladesh.

According to BB, presently 22 banks have internet banking services, but not all banks are doing it equally like that of City.

The other major players in this segment are: Standard Chartered Bangladesh, Eastern Bank Limited, Brac Bank and Dutch-Bangla Bank, according to industry insiders.

Standard Chartered Bangladesh has also seen a significant rise in its internet banking customers and transactions in recent months.

Retail clients using internet banking grew by 34 percent year-on-year in March this year and the transaction volume saw a whopping 72 percent growth, said Naser Ezaz Bijoy, chief executive officer of Standard Chartered Bangladesh.

“Many customers have become used to internet banking due to the coronavirus pandemic. This will continue to grow,” Bijoy told the Business Insider Bangladesh.

SCB has encouraged internet banking by offering cash back, he added.

EBL, which has more focus on corporate banking than retail, doesn’t lag too much behind compared to other internet banking market players. The bank has introduced SKYBANKING, a mobile phone app, several years ago for its customers who can have banking services from anywhere anytime.

Mutual Trust Bank introduced a mobile app for smartphone devices, which allows its clients instant access from anywhere in the world.

Last but not the least is the Dutch Bangla Bank, the first fully automated bank in Bangladesh. DBBL established its electronic banking division in 2002 to introduce modern banking services for its huge customers.