Health remains neglected in budget despite pandemic: CPD

BI Report || BusinessInsider

Photo illustration: Business Insider Bangladesh

The Centre for Policy Dialogue (CPD) was surprised to see that even the Covid-19 pandemic was not reason enough for the government to prioritise the country’s healthcare sector in the new budget.

The civil society think-tank in its budget analysis said that the allocation for health has been less than 1 percent of GDP for the past 13 years indicating that healthcare was never a priority sector for the government.

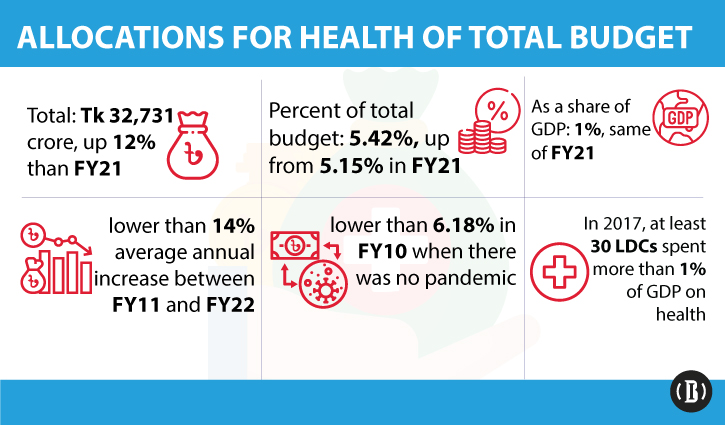

According to the CPD, in 2017, at least 30 least developed countries (LDCs) spent more than 1 percent of GDP on healthcare.

Like previous years, the CPD came up with its reactions on the proposed budget just a day after the finance minister presented his budget proposals for fiscal 2021-22 in the parliament on Thursday. Due to the Covid-19 situation, the think-tank has been presenting its analysis on budgets virtually for the last two occasions. Dr Fahmida Khatun, executive director of CPD, presented the analysis.

The budget for FY22 has been prepared in the context of a number of emerging signs in the economy. Despite challenges the economy has been able to maintain some stability and experienced some positive trends in the outgoing fiscal year, the CPD said. However, a number of weaknesses have also been visible during the outgoing fiscal year.

The weaknesses are: Deficit in revenue mobilisation, weaknesses in government expenditure, low implementation of the Annual Development Programme (ADP), subdued industrial production, gradual pressure on food inflation and low credit flow to the private sector are worrying signs.

On the other hand, some turnaround in case of export earnings and import payments, surplus in balance of payments, stable exchange rate and higher foreign exchange reserves are reassuring, it said.

Given the uncertainty on the duration of the pandemic, the CPD feels that the government should prioritise its actions for mitigating not only the immediate health and economic risks but also for smooth recovery from the ongoing shocks by allocating adequate resources and appropriate measures.

But that was not the case, in particular with the health sector amid the coronavirus pandemic.

Total budget allocation for health has increased only by 12 percent — from Tk 29,247 crore in the FY21 to Tk 32,731 crore in the FY22, which was lower than the 14 percent average annual increase in total budget allocations for health between the FY11 and the FY22.

Allocation for health as a share of the total budget has increased from 5.15 percent in the FY21 to 5.42 percent in the FY22. However, this is lower than the allocation of 6.18 percent of the budget in the FY10 when there was no pandemic.

Allocation for health as a share of GDP remained the same between the FY21 and the FY22. Such allocation is only marginally higher than the average allocation of 0.83% of GDP during the FY10 to the FY22.

The CPD has examined the context and assumptions informing the budget, fiscal budgetary framework, fiscal space and resource mobilisation targets, resource allocation, deficit financing and budget implementation challenges in view of the objectives.

Tax holiday

On top of existing 22 IT enabler services enjoying tax exemptions, the provision has been expanded to six more services that include cloud services, system integration, e-learning platform, e-book publications, mobile apps development service and IT freelancing until 2024. CPD termed it a timely move to encourage more young IT entrepreneurs.

Mega industries, such as 3-and 4-wheelers producers who invest at least Tk 100 crore and home appliance producers which promote ‘Made in Bangladesh’ will get tax exemptions for 20 years and 10 years respectively.

Establishment of vocational and technical institutions which impart training to develop skilled human resource and entrepreneurs of light engineering and IT hardware will also get a 10-year tax holiday.

CPD said all these initiatives have long-term revenue implications and use of these provisions will need to be carefully monitored.

Indirect Tax Measures

The budget has rationalised tariffs which will support domestic import-substituting industries, encourage export diversification and promote investment, the CPD said.

But these measures will likely lead to a fall in revenue collection over the medium-term and will be helpful for stimulating the economy. However, monitoring will need to be strengthened to discourage misuse.

Social safety net schemes

Allocation for social safety nets has increased from Tk 95,683 crore in the revised budget for the FY21 to Tk 107,614 crore in the proposed budget for the FY22. This represents an increase of only 12 percent, which is lower than the average rate of increase of 17 percent between the FY10 and the FY22.

Social safety net budget excluding pension as a percentage of budget decreased 13.49 percent from the outgoing year’s revised budget to 13.41 percent in FY22.

The CPD found that allocation has been cut for programmes protecting livelihoods, such as Work For Money and Skills and Employment Programme in Bangladesh. Allocation has also been cut for several programmes which address the needs of marginalised, vulnerable, and left behind communities.

Education

Reducing expenditure on education further raises the concern of addressing the issues, such as low-quality teachers, poor infrastructural management, chances of dropouts etc, CPD observed.

GDP growth and investment

The think-tank found that the government’s GDP growth projection is higher than the forecasts by World Bank (3.6%, in April 2021), IMF (5%, in April 2021) but lower than ADB’s 6.8% made in April 2021.

Private investment has been estimated to be 25 percent of GDP in the FY22, meaning that Tk 117,000 crore (approximately) will be additionally required for private investment, which is 15.6 percent increase in nominal terms.

Growth of credit to the private sector has been set at 15 percent in the FY22, almost the same as the FY21, but much higher than the trend — 8 to 9 percent — in the outgoing year.

The CPD expressed concern over the declining imports, particularly with a significant down in capital machinery import (-7.4%).

Debt

On the public debt, CPD thinks as a share of GDP it remains at a reasonable level for Bangladesh (36% in the FY20, 39% in the revised budget of the FY21).

But it may increase to some extent in FY22 (40.3%) — driven by higher domestic and external borrowing in view of the ongoing Covid-19 pandemic. At present, about 62.2 percent of the total public debt is attributable to domestic debt.

CPD concludes

The macroeconomic framework of the budget is far from reality. It takes the revised budget targets, which are unlikely to be achieved, as reference points and assumes that most of the macroeconomic correlates would perform better than the targets set in the 8th FYP.

On reforms, the budget document refers to what has been done so far. It does not spell out what concrete reforms would be undertaken to improve the efficiency in the economy. The unfinished reform agenda in many areas such as tax, customs duty, banking sector, health sector and social sector has constrained the achievement of budgetary targets and its ability to cope with adverse impacts of the pandemic

Given the magnitude of negative impact on various sectors due to Covid-19, the CPD had emphasised on the need for medium term strategy for economic recovery. The budget for FY22 has no indication on this. This puts under risk the fulfilment of the promise made in the 50th budget to move towards a resilient future by giving priority to lives and livelihoods.