Wage digitalisation in RMG sector relapses in September

BI Report || BusinessInsider

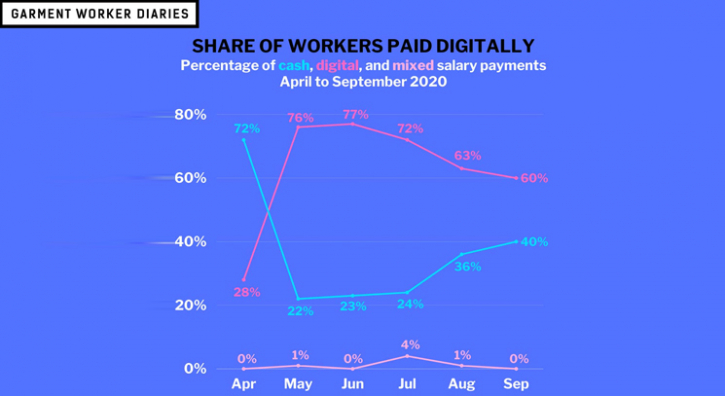

Despite an initial rise in wage digitalisation during the pandemic, the share of RMG workers receiving their salaries through digital financial services steadily dwindled in September.

In April 2020, about one in four workers were paid digitally. But in May 2020, three in four workers were paid through mobile financial services (MFS) — nearly an increase of 2 million workers, according to an ongoing research by the South Asian Network on Economic Modeling (Sanem) and Microfinance Opportunities (MFO).

But the number dropped to 60% in September.

This raises the question of whether digitalisation can be maintained in the future, remarked Dr Guy Stuart, executive director of MFO, while delivering the keynote presentation at a webinar on Saturday.

Sanem and MFO organised the webinar, titled What’s going on? Lessons from the Garment Worker Diaries: Covid Context, where they presented the findings of the research conducted through weekly interviews for two years with 1,300 garment workers.

Dr Guy Stuart pointed out that although women workers gained skills in the use of digital financial services between May and September, very few of them know how to make a cash transfer using their digital wallets. They often depend on their male counterparts to use their digital wallets.

“So, a general question arises: Are digital payments useful to workers, especially women? And how can they be made more useful?” he asked.

Kalpona Akter, executive director of the Bangladesh Centre for Workers' Solidarity, stated that the country requires more awareness and training programmes so that women can have full control over their own MFS accounts. Most of the time, the husbands take control of their wives’ earnings, she added.

Snigdha Ali, Bangladesh program officer of Financial Services for the Poor at the Bill and Melinda Gates Foundation, said wage digitalisation increases a firm’s efficiency. Interestingly, women started to save money in their digital wallets, which was not observable previously, added.

However, all these positive changes will not be sustainable without a concerted effort from every stakeholder of the RMG industry, she said, emphasising the necessity of training on digital financial skills and awareness-building programmes to make women more comfortable using digital wallets.

Dr Rubana Huq, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), pointed out that digital banks for the underserved is essential in this unprecedented time and she gave her full support to digital banking for readymade garment (RMG) workers, construction workers, and other underserved communities.

However, she added that for the benefit of every stakeholder, MFS charges need to be reduced.

Chief Commercial Officer of bkash Mizanur Rashid explained that wage digitalisation can reduce costs of a firm by around half a dollar per worker.

To facilitate the wage disbursement process, bkash has also provided subsidy on disbursement charge and cash-out charge, he added. However, Rashid reiterated that this was not a sustainable solution in the long term.

He also said that in the last couple of months, small factories have quit paying digitally. Therefore, he stressed, the needs and challenges of small firms should be carefully probed.

Dr Selim Raihan, professor at the Department of Economics, University of Dhaka, and executive director of Sanem, suggested that mobile financial services can invent new financial products specifically for RMG workers.

Attending as the special guest, ILO Bangladesh Country Director Tuomo Poutiainen said Bangladesh needs to devise its own policy considering its unique needs and situations to retain jobs in the RMG sector.

He added that the pandemic has created a disaster for the global economy, but it has also paved the way for new opportunities. Poutiainen reiterated the importance of quality of data in the context of crises such as pandemics.

He concluded his remarks with the importance of diversification in the RMG sector as well as the necessity of production of higher value products to avoid unfavourable situations.

The webinar was moderated by Dr Bazlul Hoque Khondker, professor at the Department of Economics, University of Dhaka, and chairman of Sanem.

Around sixty researchers, academicians, development practitioners, journalists, and students from home and abroad also attended the webinar.