48% loans disbursed from CMSME package

BI Report || BusinessInsider

Photo: Business Insider

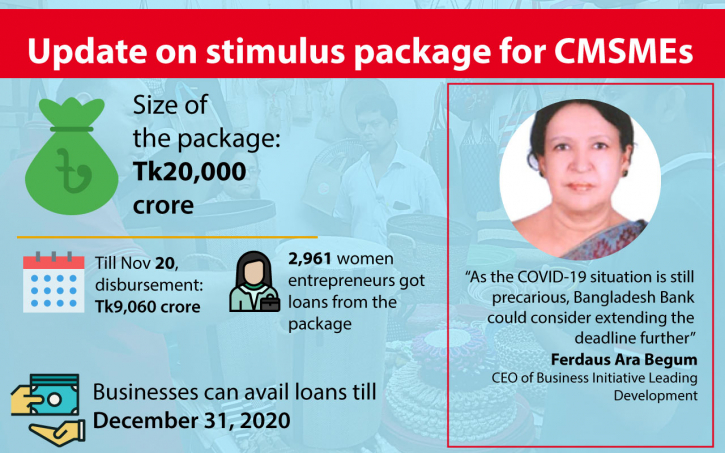

Banks have disbursed nearly half of the Tk20,000 crore stimulus loans for cottage, micro, small and medium enterprises (CMSMEs), said a senior official of the central bank on Monday.

Husne Ara Shikha, general manager of SME and Special Programs Department of Bangladesh Bank, said the disbursed amount from the package is Tk9,060 crore or 48% of the total amount.

She made the disclosure at a virtual discussion organised by the Business Initiative Leading Development (BUILD) in collaboration with the International Trade Centre (ITC) on access to CMSME loans.

Shikha said around 2,961 women entrepreneurs have availed loans from the Tk20,000 crore stimulus package across the country.

“Yet, the amount availed by women is only around 2% of the total package, down from the 5% target set by the central bank,” she said.

She emphasised on creating awareness to facilitate women entrepreneurs on access to finance with the support of chambers, business associations and think tanks.

In order to facilitate the trading sector, the Bangladesh Bank has already withdrawn the Tk1 crore-limit for loans, she noted.

Ferdaus Ara Begum, CEO of BUILD, delivered the keynote presentation, in which she appreciated the central bank’s initiative of extending the deadline of the Tk20,000 crore stimulus package for CMSMEs till December 31, 2020.

“Detailed implementation statuses of different packages should be officially published by Bangladesh Bank with disaggregated data,” she said.

The BUILD CEO also stated that e-Commerce businesses face challenges in obtaining trade licences. In this case, formal registration with chambers and associations can be treated as an alternative to trade licence, she said.

Syed Abdul Momen, head of SME at BRAC Bank, informed that BRAC Bank has already disbursed Tk1,000 crore of the stimulus package out of the targeted amount of Tk1,100 crore.

He suggested that the threshold for trading sector could be further increased up to 45% as a huge number of trading businesses are consolidated in the cottage and micro sector.

Ali Sabet, team leader of PRISM, urged the Bangladesh Bank and the private sector to take the lead for monitoring the issue of Credit Guarantee Scheme (CGS). He suggested that the CGS could be an autonomous body.

He said that the government should provide comprehensive business support to CMSMEs in Bangladesh with special focus on industrial clusters around the country. BSCIC could extend their support through the 64 service centres in the district level, he said.

Suman Saha, assistant general manager of SME Foundation, said they provide up to Tk15 lakh collateral-free loan to women entrepreneurs.

Tanvir Ahmed, country coordinator of SheTrades Initiatives of International Trade Centre (ITC), requested to extend the disbursement time of the package by considering the evolving situation of Covid-19. He also demanded to increase the limit for women entrepreneurs from 5% to 25%.

Muhammad Abdul Wahed Tomal, general secretary of e-CAB, emphasised on introducing special trade licence for facilitating e-commerce and f-commerce business as they do not have any physical location for their business.