Taka depreciation benefits exporters, fuel up import costs, inflation

BI Report || BusinessInsider

Taka has been depreciated against the US dollar, raising concerns of aggravating inflationary pressure in home market. Business Insider Image.

Breaking a foreign-exchange equilibrium that had been maintained for nearly two years, Bangladesh Bank recently paved the way for depreciating Taka against the US dollar in a bid to give exporters a leverage over their competitors.

According to analysts, this move may fuel up the inflationary pressure as importers have to pay more because of the exchange rate at a time when commodity prices are increasing in the international markets.

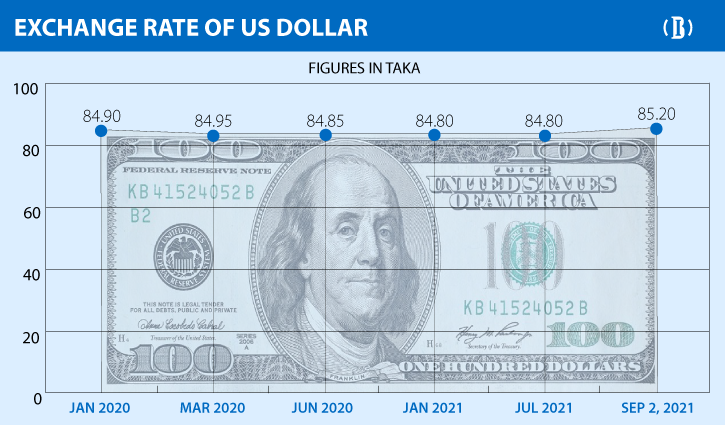

Bangladesh Bank data shows, a dollar was traded at Taka (Tk) 85.20 in the inter-bank on Thursday (Sep 2) and Tk 85.25 for import payments, up from Tk 84.85 a month ago.

The exchange rate has been almost at an equilibrium at Tk 84.80 to Tk 84.90 for around two years despite a decline in demand for the greenback, especially as the Covid-19 pandemic hit the country in March last year.

This depreciation of local currency against the greenback has raised a number of questions.

Firstly, Bangladesh is sitting on a huge foreign exchange reserve – over $48 billion, which is enough to meet the country’s import payments for 10 months.

Secondly, prices of commodities, be it industrial raw materials or oil, gas and metal, are rising in the international market, a development that will aggravate the inflationary pressure.

Thirdly, exporters and remitters who will benefit from the dollar appreciation have already been enjoying cash subsidies that make their effective exchange rate higher than others. Bangladesh’s garment exporters get 1 percent cash incentive against their export amount and it goes up to 4 percent for exporting to non-traditional markets. Remitters have also been getting a blanket 2 percent cash incentive for the past two years.

“This depreciation will boost our exporters’ competitiveness as the currencies of India, Pakistan and Vietnam were depreciated in the last two years,” said a senior Bangladesh Bank official.

He, however, refused to comment on the cash incentive that makes the effective exchange rate for exporters higher than the market rate.

Treasury heads at different commercial banks, however, said the depreciation of taka against dollar will fuel inflation as importers have to pay 50 paisa more for one dollar than what they paid a month ago.

“Of course, there will be inflationary pressure as prices of commodities are rising in the international market,” said Mehdi Zaman, deputy managing director and the head of treasury of EBL.

He said the demand for the greenback is higher now than the supply as earnings from exports and remittances went down in July. On the other hand, import has increased by over 21 percent.

Treasury head of another private bank, however, said when the demand was low last year, why did the central bank not let the market behave based on the demand and supply mechanism. He said Bangladesh Bank artificially kept the exchange rate of dollar almost fixed at Tk 84.80 for over a year.