Corruption is a big barrier to Bangladesh’s business competitiveness: WEF

BI Report || BusinessInsider

The most problematic factors for doing business in Bangladesh

Corruption and poor governance in Bangladesh are the weakest areas in the business competitiveness where the majority of indicators are perceived to be deteriorated.

Weakest indicators are bribes for awarding public contracts, bribes for export and import, bribes in connection with tax payments and ethical standards of politicians. Corruption has become a major burden for businesses which reduce competitiveness both in local and global markets, according to the Global Competitiveness Report 2020 released on Thursday.

In this year’s Global Competitiveness Report, because of the pandemic and the inability to collect necessary data, country rankings in the report have been suspended. Bangladesh had slipped to 105th out of 141 nations on the global competitiveness report 2019.

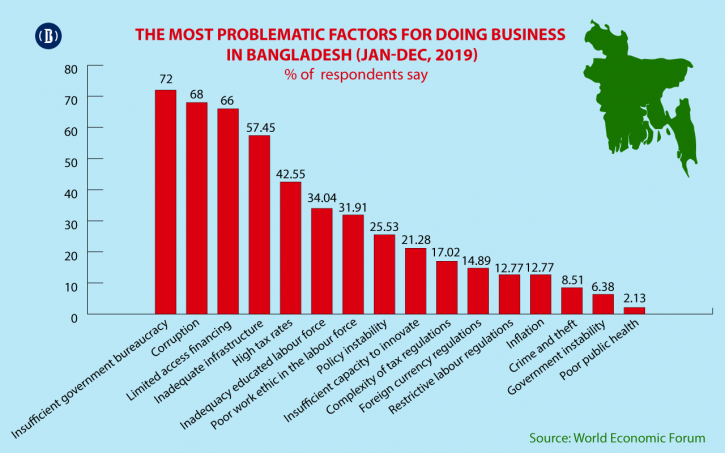

Entrepreneurs identified inefficient government bureaucracy, corruption and limited access to finance as the top problematic factors in Bangladesh during Jan-Dec 2019, according to the latest report.

Inadequate infrastructure which was long been considered one of the top three problematic factors has been receded to fourth important factor

Other important factors include inadequate educated labour force and poor work ethic in the labour force.

On governance, the majority of governance related indicators have experienced deterioration during 2019. Marginal improvement in perception is observed in case of intellectual property protection, less use of bribes in import and export and weak property rights, said the report.

On infrastructure, the report said entrepreneurs’ perception on infrastructure has improved in 2020 but level of improvement is still inadequate to ensure an accepted level of quality and efficiency of services.

Noticeable progress is observed in case of air-transport facilities. Despite significant public investment for infrastructure development over the last one decade, quality and standards of essential infrastructure services have yet to reach the accepted level.

About technology, the report said Bangladesh’s technology has been confined only to online gig economic activities. Working conditions in businesses is not conducive for gig economy-oriented activities. Bangladesh to a large extent is not ready on using digital tools, robotics, app- and web-enabled markets, and legal framework of those technologies.

On education and human capital, the report mentioned that entrepreneurs have negatively acknowledged the performance of most of the indicators related to education and human capital.

Significant positive changes in perception observed in case of a country's ability to attract highly skilled individuals from abroad. Lack of skilled professionals at local level forced companies to recruit increasing number of foreign professionals which further squeezed opportunities for local professionals

The report said the financial sector continued to struggle with its poor performance. All performance indicators are in negative terrain. Over 60 respondents expressed their dissatisfaction about weak soundness of banks though the level of response has somewhat improved. Sixty-percent entrepreneurs perceived that the financial auditing and reporting standard is weak and the level of weakness has deteriorated further.

Access to finance is largely targeted to large scale enterprises where SMEs and start-ups find it difficult to get necessary credit support, said the report.

About foreign trade and investment, it said entrepreneurs perceive that the domestic business environment has deteriorated during 2019 although businessmen perceive that a positive environment exists in the country. Thirty-three percent respondents mentioned that non-tariff barriers somewhat limit domestic competition which was better compared to the last year.

Some 57 percent entrepreneurs were hopeful that supply chains will evolve with more flexibility and business opportunities will enhance within the next five years. Domestic competition remained in weak state during 2019, as seventy-four percent respondents mentioned corporate activities dominated by a few business groups where marginal improvement was visible in 2019.

The report said perception regarding the banking sector has further deteriorated in 2019. Seventy-five percent of entrepreneurs indicated the central bank’s poor quality in monitoring and supervision of banks which has deteriorated in 2019.

On the capital market, eighty-percent entrepreneurs said that SEC’s weak monitoring and supervision has significantly deteriorated in 2019.

Bangladesh needs massive regulatory reform targeting public services, financial sector, public sector enterprises with a view to ensuring efficiency, accountability and transparency, the report suggested.

It said the regulatory bodies need to ensure delivering required services in quality, on time and without any corruption.