IMF for further slashing profits on savings certificates, Bangladesh reluctant

Asif Showkat Kallol || BusinessInsider

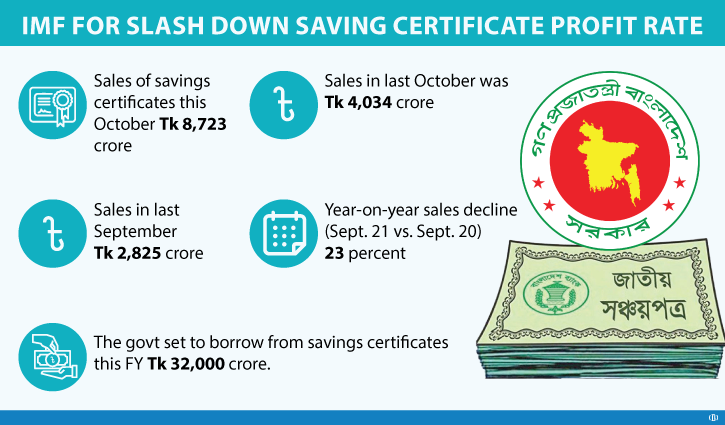

The illustration depicts sales of savings certificates in Bangladesh. BI infographics.

The International Monetary Fund ( IMF) asks the government if they have any plan to further lower the profit rates on various National Savings Certificates after the rates were cut four months ago, an official of the finance division said.

The Internal Resources Division (IRD) of the Finance Ministry in September trimmed the average profit rate of NSCs to 10 percent from the previous 11 percent to discourage people from buying these instruments and rather go to the stock market.

The government wants to study the social and economic impacts of the lower returns on the NSCs where the country’s middle class have put a part of their savings.

"The reduction in returns of the savings certificates is now sensitive and it may become a politically sensitive matter if it is tagged with future IMF credits to the country," an official of the finance ministry said.

He said further cutting in profits of the saving certificates within a short time as per IMF intention looks difficult.

"But we hope that the people will go to stock markets to vibrate the Bangladesh’s capital market,” the official pointed out.

The visiting IMF Article IV team sat with the officials of the budget wing of the Finance Division as they wanted to learn about some aspects of the next national budget.

They sat with the finance ministry and Bangladesh Bank in the last couple of days, too.

The delegation, known as Article Mission IV, led by Rahul Anand, the IMF's Assistant Director for Development, arrived in Bangladesh two weeks ago and their trip will end on December 19.

Usually, the IMF mission suggests tighter eligibility criteria and moves towards market-based pricing to reduce reliance on national savings certificates, help strengthen financial intermediation and expand the capital market.

Former Finance Adviser to the caretaker government, Dr AB Mirza Azizul Islam told Business Insider Bangladesh on Friday that government should study the strings and make it public before finalising any new deal with the IMF.

"If the IMF proposes further reduction in the profit rate of the savings certificates of Bangladesh, it is the government that will make the final decision after examining the pros and cons of the Fund’s proposal,” he said.

Meanwhile, the effect of lowering profit rates on savings certificates has already begun to surface, as its net sales declined by 73% in a single month in October this year.

According to the latest statistics of the Directorate of National Savings (DNS), the total sales of savings certificates in October this year was worth Tk 8,723 crore. In October last year, the net sales was worth Tk 4,034 crore and in September Tk 2,825 crore, respectively.

This September the sales of the savings tools amounted to Tk 8,722 crore, which itself is a year-on-year decline by Tk 2,627 crore, or 23.14%.

In the current fiscal year FY22, the government borrowing target from net savings certificates sales has been estimated at Tk 32,000 crore.