Bangladeshi tech startups raise highest-ever investment in 2021

BI Special || BusinessInsider

Photo illustration: Business Insider Bangladesh

Bangladeshi startups can cheer up for the investments they have bagged in the outgoing year. Yet, the figure was a drop of ocean compared to that of neighbouring India.

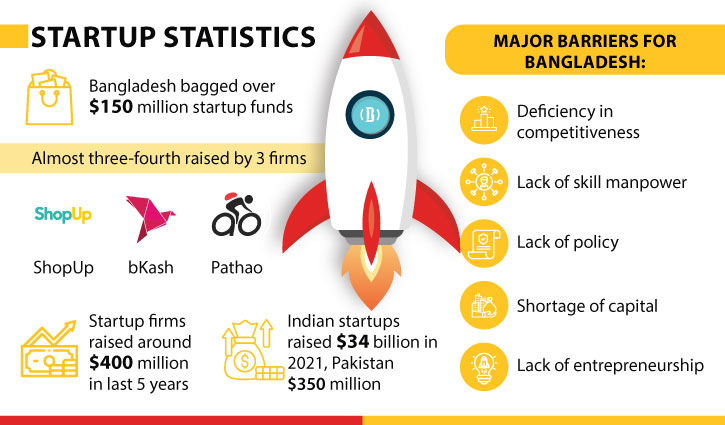

According to industry insiders, new-age digital startups in the country received $150 million to $200 million investments in 2021. The amount was half of the investments Bangladeshi startups got so far from venture capital firms and individuals in the last 10 years.

Interestingly, three-fourth of the investments that came into Bangladesh in 2021 was in three firms – ShopUp, bKash and Pathao. Of which, ShopUp alone got $75 million investments from Peter Thiel’s Valar Ventures and Prosus Ventures. Other significant fundraisers were: PaperFly ($11.8 million), Praava ($10 million) and Chaldal ($10 million).

On the other hand, Indian startups have got $34 billion investments as of December 17, 2021, according to data from Venture Intelligence. Over one thousand deals were signed to bring these investments into India. But there were around three dozen deals in Bangladesh in the outgoing year.

Startups of Pakistan, another South Asian nation, also bagged over $350 million in the outgoing year, according to media reports.

Why does Bangladesh lag behind in raising startup funds despite its impressive economic growth and rising purchasing power of consumers?

According to industry insiders, skilled manpower, time-befitting regulations, availability of funds and entrepreneurship skill can take the country to growth and competitiveness of digital startup companies.

“Potential local investors are not investing in startups and the capital we have raised so far, 95 percent were from abroad,” said Fahim Ahmed, CEO of Pathao, one of the largest local tech startups in the country.

“But potential foreign investors want to see how much the local players are in operations in the industry,” he said.

Ahmed also blamed the poor pace of technology adoption as another major reason for Bangladesh’s lack of tech startups. Countries like India and Indonesia are far ahead than Bangladesh in technology adoption, he added.

Pathao, which is Bangladesh’s largest digital services platform and market leader in ride-sharing, food delivery, and e-commerce logistics, has raised around $35 million venture capital in 2021.

AKM Fahim Mashroor, CEO of job site bdjobs.com and AjkerDeal.com, said though Bangladesh’s economy has been rising steadily, the size of the digital consumers did not increase that much.

“Some people have an abundance of money, but most people do not have enough to buy a low-cost smartphone,” Mashroor said.

He also pointed out two other reasons – absence of regulations and lack of entrepreneurship skill – for which Bangladeshi digital startups don’t get funds.

On the regulations, he said no company except banks can invest in fintech firms in Bangladesh. But huge funds came in to fintech firms in India and Pakistan, he noted.

On the entrepreneurship skill, Mashroor said many Indians and Pakistanis came back to their countries after education and work experience in Silicon Valley, but it did not happen in Bangladesh.

Global venture capital investment is likely to double at the end of this year, according to data from a US research firm.

Data from CB Insights show venture companies raised a total of $437.7 billion worldwide in the first nine months of 2021 and at that rate total investments would stand at more than $580 billion at the end of 2021.

The research firm said investor interest in online services in the health care, financial and retail sectors drove the investments.