Cement industry sees record sales in Covid-19 crisis

BI Special || BusinessInsider

Photo: Business Insider Bangladesh

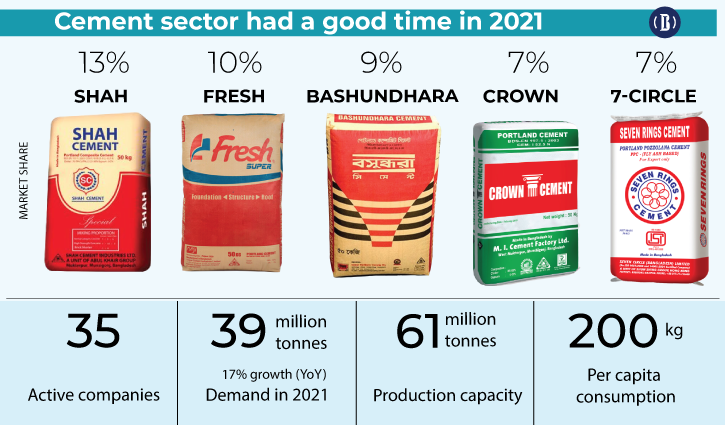

Bangladesh has witnessed record sales in volume of cement in 2021, supported by economic recovery from the fallout of the coronavirus pandemic and a rise in consumption by numerous government projects, industry insiders said.

They said the demand for cement increased by 17 percent to 39 million tonnes in 2021, highest in the country’s history.

According to data from the Bangladesh Cement Manufacturers Association (BCMA), cement demand was 33 million tonnes in 2019, the pre-pandemic year. But the demand went down in 2020 when the country was in 66 days of lockdown to contain the spread of the virus.

Most of the companies saw a rise, more or less, in their sales in the last year.

For example, LafargeHolcim, a multinational cement producer, achieved a 27 percent increase in its net sales to take the figure to Tk 2,053 crore in 2021 compared to Tk 1,622 crore a year ago.

Similarly, Fresh Cement, a concern of Meghna Group of Industries, has witnessed strong sales throughout 2021. Relatively new entrant Akij Cement, a brand of Akij Group, has also been seeing a consistent growth in the last two years.

“Cement sales went down significantly in 2020 due the coronavirus pandemic. The market saw a strong recovery in 2021,” said Zahir Uddin Ahmed, managing director of Confidence Cement, one of the oldest local cement makers in the country.

Mohammed Khurshed Alam, executive director of Meghna Group of Industries that makes Fresh Cement, also echoed Ahmed about the market growth in the last year.

“Consumers bought more cement in 2021 as they could not do in 2020 because of the impact of the coronavirus,” said Alam explaining the reasons for a rise in their sales.

He said the industry had a 1 percent de-growth in 2020 after achieving average 8 percent growth for a decade.

“In 2021 main growth came from infrastructure projects being implemented by the government,” Alam told the Business Insider Bangladesh.

However, industry insiders said the positive sales trend may not last this year as the sector has been facing a number of challenges, including rising raw material prices and an uneven competition among companies.

“Clinker is being sold at nearly $60 a tonne in the international market. But we cannot pass this cost on consumers because of price competition,” said a senior official of a foreign company in Bangladesh.

Ahmed of Confidence Cement sees a new challenge that can reduce their sales in the coming days.

“Steel prices have skyrocketed. So, consumers may take a pause to build houses and other infrastructure,” he said.

History of cement in Bangladesh:

The history of the cement industry of Bangladesh is not as old as other countries. The first cement factory named ‘Chattak Cement Factory Ltd’ (formerly known as Assam Bengal Cement Company Limited) was established in Sylhet in 1941 during the regime of British India.

After the creation of Bangladesh, the second factory called ‘Chittagong Cement Clinker and Grinding Factory Ltd’ (now being operated as Heidelberg Cement) took place in 1973 in Chittagong. After that, no such factory came in until the early nineties despite a consistent growth in demand between 1970s and 1990s. The requirement had been fulfilled through import, mainly from countries like Indonesia, China, Malaysia, and India.

Then dozens of local companies came in to the market to produce cement in Bangladesh. these companies include Confidence Cement, Hyundai Cement Bangladesh, Meghna Cement of Basundhara Group, Ahad Cement Factory, Aramit Cement, Mongla Cement of Sena Kalyan Sangstha, Diamond Cement, Lafarge Surma Cement and Eastern Cement etc.

Later, a good number of large, medium and small companies came into the market to have their shares. These include Shah Cement, M I Cement (Crown Cement), Meghna Group of Industries (Fresh), Premier Cement, Seven Circle (Bangladesh), Heidelberg Cement Bangladesh, Holcim (Bangladesh), Royal Cement and Cemex Cement Bangladesh and there were many small producers across the country.

Once the market was dominated by foreign companies, but now they are facing intense competition with the local makers. Two of the global cement groups — UAE-based Emirates Cement and Mexico-based Cemex — winded up their Bangladesh operations failing to penetrate the market.

Now Bangladesh’s cement factories have a capacity to produce double the country’s present demand, leaving some regional small companies out of the market. Top 10 companies including two multinationals, hold around 80 percent of the total market share.