FDI cost of Russia’s assault on Ukraine

BI Desk || BusinessInsider

Graphics: Business Insider Bangladesh

Soon after Russia launched its attack on Ukraine on Thursday, western countries have imposed a set of sanctions on Russia’s banks and oligarchs.

Russia and Ukraine have a combined stock of accumulated foreign investment worth about $500 billion. The bulk of it comes from European and US investors or OECD countries. Massive sanctions will definitely cost their assets in the region.

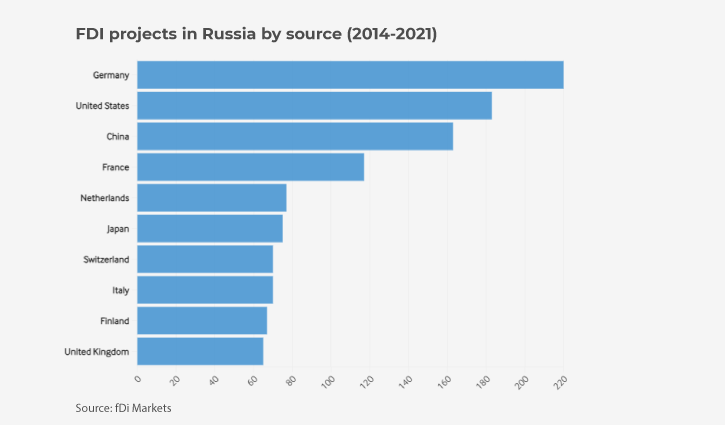

Despite the embargoes levelled in the wake of the 2014 crisis centring Crimea, Western businesses make up the bulk of the inward investment that flows into Russia every year.

According to foreign investment monitor fDi Markets, on average, investors from OECD countries made up over 80 percent of the FDI projects announced in Russia since 2014.

“There will be a major operational hurdle to be able to conduct business [in Russia moving forward]. It’s very difficult to understand how financial payments will be processed [if major Russian banks are sanctioned],” says Livia Paggi, the head of the geopolitical risk at GPW Group.

Russia’s key sectors that attract FDI — real estate, oil and gas, food and beverages, automotive — now hangs in the balance as Western allies threaten to cut out Russian banks from the European and US financial markets.

The impact of the sanctions reflected on the country’s stock market. When the news of the invasion broke, the Russian MOEX equity index plummeted by the most on record to about 50 percent below the high recorded in October 2021.

These sanctions make it “very problematic” for foreign businesses to deal with Russia, analysts said noting that it will be even more difficult if the country’s largest banks such as VTB and SpareBank are included in the sanctions.

However, the Russian fossil fuel industry is well connected with western multinationals. Therefore, leaders of western countries now are faced with a balancing act between sanctions and maintaining the supply of resources from Russia.

Analysts also fear the sanctions will lead Russia to become even more dependent on China.

“Chinese firms are unlikely to have the same reservations when it comes to investing in Russia, particularly in the natural resource sector. Russia’s decision to invade Ukraine will be sure to accelerate Moscow’s ‘Pivot to the East’,” said Hugo Brennan, the head of research for Europe, the Middle East and Africa at Verisk Maplecroft.

FDI outlook for Ukraine

The country’s accumulated stock of FDI stood at $48.9 billion at the end of 2020, according to UNCTAD data.

Although Ukraine is not the target of western sanctions, its FDI outlook is more vulnerable to the conflict.

Global investors will be keen to hedge risk and freeze any new FDI plans at least for the short term, particularly towards some businesses that are physically operating near the east of Ukraine.

However, Ukraine has recently benefited from an influx of foreign software companies, with a record number of greenfield investments into its technology sector during 2021, according to fDi Markets.

While analysts expect a significant curtailment of FDI flows to Ukraine, the ability of foreign companies to divest will be limited in certain sectors, particularly in less agile operations such as oil drilling or logistics.

There is less possibility for foreign tech companies to exit Ukraine due to the attractiveness of the market and its talent.

Then again, these tech companies will likely be caught up in their partnerships with any sanctioned Russian banks.