Import data explains some reasons for growing inflation

BI Special || BusinessInsider

Graphics: Business Insider Bangladesh

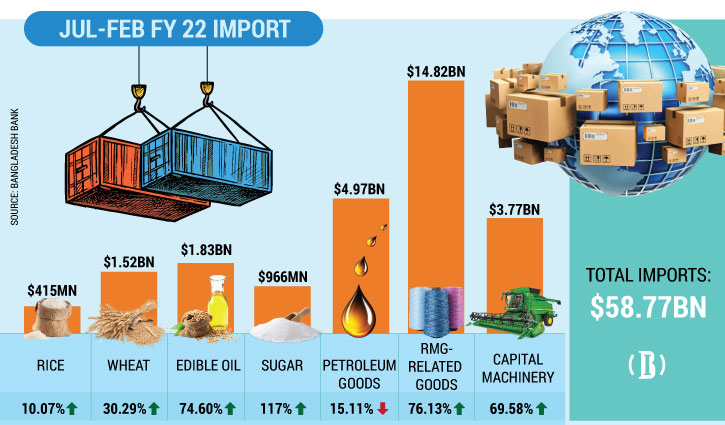

In February this year, the inflation rate in Bangladesh jumped to a 17-month high of 6.17 percent. The figure published by the Bangladesh Bureau of Statistics (BBS) was no surprise as the two years of pandemic and the recent Ukraine war have increased the prices of almost everything.

There are many variables that come into play for prices to go up or down. But prices of import-heavy products depend mostly on import costs. The latest Bangladesh Bank figures on import costs paint a picture of why the prices of some items too often have been going wild.

It is logical that the prices of import-depended goods would rise according to import costs. On top of that, prices of these products can rise with VAT, AIT, other tariffs, marketing, transportation and other costs.

The matter of dishonest business practices like artificially disrupting supply to hike prices also factors in what the end price of a product comes down to. Considering all these, import costs tell at least a portion of the picture of why inflation has been on a growing trend in the country.

Bangladesh Bank data shows import costs have risen for almost all products, except for oil, and petroleum. Among the products, pharmaceuticals, fertilizer, yarn, and sugar import costs have risen above 100 percent.

Food items:

Bangladesh’s economy faced 6.22 percent inflation on food items in February, which was 5.6 percent in January. Behind this, figures show Bangladesh spent over $1.9 billion (Tk 16,706 crore) on food grain imports in July-February ’22 period, up 25.7 percent from the corresponding period a year ago.

Among these, the cost of rice imports increased by 10 percent and wheat by 30 percent. Among these two food essentials, rice is not heavily import-dependent, while wheat is.

Trading Corporation of Bangladesh (TCB) figures show rice prices increased by less than 5 percent, and decreased for some varieties.

On the other hand, reflecting import cost growth, flour prices (coarse and fine) increased by around 30 percent in the Jul-Feb period.

Bangladesh in the first seven months of FY22 imported 2 million tonnes of wheat. It was 5.3 million tonnes in FY21.

It must be noted that almost half of the world’s wheat supply comes from Russia and Ukraine. The war between two east European neighbours is likely to further inflate wheat prices.

Among other consumer goods, sugar import cost rose the highest by 117 percent in Jul-Feb from the previous corresponding period. Sugar import cost was $965 million in this period.

However, TCB data shows sugar prices increased by Tk 10 (14.5 percent) in this timeframe.

Meanwhile, surprisingly import cost of much-talked-about edible oil increased by 74 percent during the period. Bangladesh spent $1,831 million on edible oil during this period, up from $1,048 in the previous corresponding period.

Meanwhile, the edible oil market price increased by Tk 100 per 5 litres. It was Tk 670 in July 2021 and jumped to Tk 790 in February. TCB data shows soybean oil prices increased around 20 percent during this period.

The government recently withdrew VAT on edible oil imports in an effort to rein in the soaring prices of the essential commodity.

Intermediate goods:

The import cost of crude petroleum is one of the few items on the list that saw a reduction in Jul-Feb ’22. During this time, petroleum import cost was $573 million, while it was $2,388 million in the previous period — a 76 percent reduction.

Costs of pharmaceuticals (336 percent) and fertiliser (215 percent) imports increased the highest among all goods during the Jul-Feb ’22 period.

Pharmaceutical product imports cost jumped to a massive $1,004 million in Jul-Feb ’22 from only $230 million in the corresponding previous period.

Capital goods:

In a rapidly growing economy like Bangladesh, capital goods are a vital cog in the wheel of the economy. It is, for obvious reasons, also heavily dependent on imports of such goods. Products that are less dependent on imports may see a price hike due to the high cost of machinery imports.

Capital machinery import cost was $3,772 million Jul-Feb ’22, jumping by 69 percent from the previous corresponding period’s $2224 million.