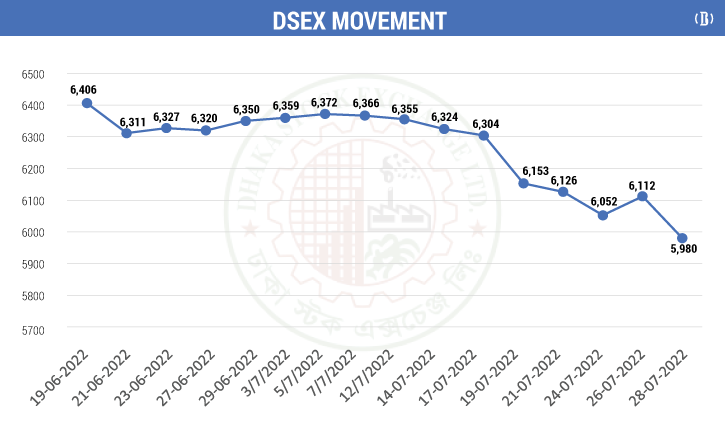

BSEC reintroduces ‘floor price’ to halt market slide

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

In a bid to prevent the capital market from further decline, the regulator has once again introduced a ‘floor price’ system to avoid a free fall in share prices.

A price floor is the lowest price that one can has to pay for each share.

On Thursday (July 28), Bangladesh Securities and Exchange Commission (BSEC) Chairman Prof Shibli Rubaiyat Ul Islam issued an order in this regard, which will be effective from Sunday (July 31).

According to the order, from Sunday, the previous five-day average closing price will be the floor price of each company.

The price of shares above this can rise at the normal rate. However, it cannot go below the floor price.

However, due to bonus shares or right shares of the company, the price of the securities in the floor price will be adjusted.

Meanwhile, in the case of new shares, the closing price of the first day of trading will be considered as the floor price.

Earlier in 2020, the outbreak of the coronavirus pandemic, to prevent the collapse of the stock market, on March 19 of that year, the commission fixed the minimum price of the shares of each company and determined the floor price.

Then in three steps, the current commission lifted the floor price.