72% firms yet to get stimulus loans: SANEM

BI Report || BusinessInsider

Some 72% of the firms in Bangladesh have yet to get any loans from the stimulus packages announced by the government to offset the impacts of the ongoing coronavirus pandemic.

SANEM, a local think-tank, found this in a survey conducted among 502 firms, 252 of which were from the manufacturing sector and 250 from the service sector.

This is SANEM’s second round of the quarterly survey titled Covid-19 and Business Confidence in Bangladesh: Towards Economic Recovery, conducted in October and released on Saturday at a webinar. Findings of the first round of the quarterly business confidence survey were disclosed in August.

Speaking at the webinar, Dr Selim Raihan, professor of Economics at Dhaka University and executive director of SANEM, said that although business confidence for the next quarter has improved slightly, it is clear from the study that businesses are still quite skeptical of the future.

The study also confirms that the experience is not consistent across all firms — large and medium firms have shown greater improvement and are therefore more confident compared to micro and small firms, he added.

Dr Selim stressed the importance of proper implementation and disbursement of the stimulus packages for small and medium enterprises (SMEs).

Asked about the reasons behind not availing the stimulus package, 96% respondents said they did not take the fund since it was not a grant.

Some 92% said they found the procedure to be too lengthy, while 84% mentioned difficulties in getting bank-related services as the main reason for not availing the package.

Although 84% respondents in the first round had said there were no packages available for their industries, that reduced by 2 percentage points in the second round. Furthermore, 69% of the firms that did avail stimulus funds said that the procedure of getting loans under the package is too lengthy.

About 65% of the firms said they faced difficulties with bank-related services, while 53% said they had difficulties in getting information or understanding the procedure.

Regarding the major challenges of doing business, 87% survey respondents blamed corruption. Some 77% of the respondents said trade logistics at the port and customs was a big challenge to doing business in Bangladesh.

Participating as a panellist at the webinar, Dr Ahsan H Mansur, executive director at the Policy Research Institute of Bangladesh, mentioned that the survey findings were consistent with his own assessments of the present situation.

He further opined that such findings would help to correct the overly optimistic predictions regarding Bangladesh’s future growth prospects that have been presented by several quarters since the start of the pandemic.

Although Bangladesh has performed better than India and some other economies, the government should not be complacent regarding the future economic outlook, he added.

Dr Mansur noted that “entrepreneurs are showing caution and rightfully so.”

The eminent economist also acknowledged that availing finance is a much bigger challenge for SMEs, unlike large companies that have access to international finance. Therefore, the government needs to comprehend a second stimulus package with a focus particularly on SMEs, he suggested.

Chittagong Stock Exchange Chairman Asif Ibrahim mentioned that one of the key decisions that helped the Bangladeshi economy weather through the global crisis was the timely decision of gradually opening export-oriented sectors.

However, the survey revealed that different sectors are experiencing recovery at varying paces.

Faster recovery is taking place in RMG, textile, pharmaceuticals, food processing, retail, restaurants, finance sector, and ICT. But leather, light engineering, wholesale, transport, and real estate sectors are going through a slow recovery period.

The report also found that small firms were largely out of stimulus package coverage. Out of the 301 micro and small firms surveyed, only 8% of the firms have received stimulus funds. In the case of large firms, out of 157 firms surveyed, 41% received loans from the stimulus package.

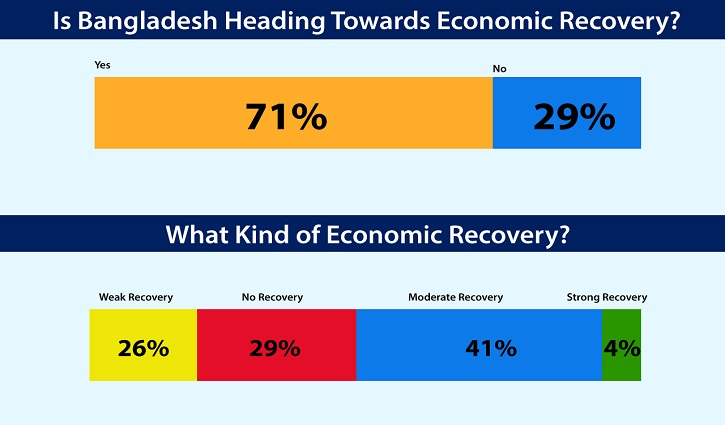

Of the surveyed firms, 71% think that Bangladesh is on the path to economic recovery; only 4% consider it a strong recovery, while 41% and 26% think it as moderate and weak recovery, respectively.

Among others, Abul Kasem Khan, managing director of AK Khan Telecom Limited, Maliha M Quadir, founder and managing director of Shohoz Limited, and Dr M Masrur Reaz, chairman of Policy Exchange of Bangladesh, also spoke at the webinar.