Foreign trade: Govt contemplates a mix of foreign currencies to tame inflation

Asif Showkat Kallol || BusinessInsider

Graphics: Business Insider Bangladesh

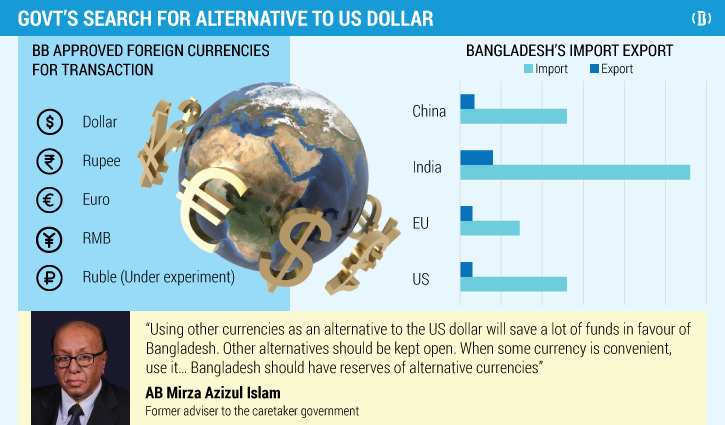

Bangladesh Bank is looking for alternatives to major transaction mediums, as the crisis of US dollars intensifies in the country, a finance ministry official said.

“The use of the Euro as an alternative has already been started by the central bank. The list also includes Indian curreny Rupee, Chinese currency RMB and Russian currency Ruble,” he added.

As dollar crunch led stakeholders to free fall of Bangladesh’s Taka, inflation escalated, pushing oil prices and imports even more expensive.

The central bank currently approved the use of dollars, euros, rupees, and RMB for foreign transactions. The approval of the Russian currency, ruble, is now being experimented.

Industrial entrepreneurs believe since Bangladesh is an import-dependent country, some transaction benefits could be accrued by using a mix of currencies.

As some 40 percent of Bangladesh’s total imports are from India and China, Rupee and RenminbI look pretty to handle the trades.

The values of these two currencies against the dollar have also fallen more than the Taka. As a result, making import payments with those currencies will save Bangladesh some more, officials pointed out.

In this case, the central bank should increase the supply of rupees and RMB. And, a part of the vault should keep these currencies.

Incidentally, the price of the US dollar has increased by 12 percent in the last one year. The dollar also rose against other currencies. As a result, if the product is imported by LC in dollars, the price is higher. However, if local businessmen import goods in other currencies instead of US dollars, the cost gets lower.

Because of such awe, transactions in other currencies are encouraged by the central bank.

The US dollar is the major foreign exchange currency of India. But the country is doing transactions with Japan in their own currencies. In this, the transactions that are outstanding at the end of the year, are adjusted to the next year. South Korea also trades with other countries in its own currency. China trades bilaterally with many countries in their respective currencies.

Dhaka and Beijing has created a structure to trade with Bangladesh in Taka. It is also doing so with Pakistan. Russia is trading with many countries including China, India in their own currencies. Through this, they continue to try to protect their economy from the heat of the greenback.

The leading economists of the country believe use of other currencies as an alternative will save Bangladesh’s economy from getting too heated.

In this context, the former advisor to the caretaker government, AB Mirza Azizul Islam, told Business Insider Bangladesh that using other currencies as an alternative to the US dollar will save a lot of funds in favour of Bangladesh.

The prices of the UK pound also fell. The price of the euro is low now. Bangladesh could exploit this situation by trading with European nations.

He also said that many alternatives should be kept open. When some currency is convenient, use it. For this the central bank has to play the main role. He thinks Bangladesh should have reserves of the alternative currencies.

Entrepreneurs need to understand the benefits. Then it will be beneficial, Azizul added.

According to the Bangladesh Bank, Bangladesh has the largest trade with China as a single country. It is followed by the United States and India. As a region, Bangladesh’s most trade is done with the European Union countries. China alone accounts for 26 percent of Bangladesh’s total imports and 3 percent of its exports. Chinese Yuan earning will be lower due to lower exports to China. On the other hand, as imports are high, RMB spending will be high. As a result, there will be a shortage of Chinese currency. To meet this deficit, RMB should be provided from the central bank’s reserves. This is why a sizable reserve of RMB could be created.

There are some problems, too.

Executive president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Mohammad Hatem told Business Insider Bangladesh that the cost of importing products in Euros will be lessened due to the current price of Euro. But if the local businessmen export, the income will be less.

As a result, exporters will not want to squeeze their receipts. Again, the RMB that will be earned by exporting to China, should be spent only in China. It cannot be spent elsewhere, he added. Then again, it has to be converted into another currency and imported. It will increase the cost. Due to this, the use of alternative currencies is not getting popular.

However, with Bangladesh Bank’s support, importers and in some cases exporters can also use alternative currencies. It will save a lot, he added.

According to a Bangladesh Bank, 26 percent of the country’s total exports and 3.5 percent of its imports are with the United States. Exporters are bagging good income as dollar price increases. But imports are suffering.

India accounts for 14.5 percent of total imports and 3 percent of exports. These transactions are done in dollars. As a result, the cost is increasing as the import is more. Using taka and rupee in foreign trade with India will save a lot. Because the depreciation of the rupee against the dollar has been more than that of Taka. But due to low exports to India, the supply of Rupees is low. In this case, emphasis should be placed on the exchange of money for Rupees.

Some 56 percent of the country’s total exports and 8 percent of its imports are done with the European Union. The depreciation of the Euro will reduce export earnings. Import costs will also decrease. But imports from Europe are not that large. As a result, the use of euros earned by exports is less.