Income tax collection can be raised 3-fold from 1% of GDP: Research

BI Report || BusinessInsider

Graphics: Business Insider Bangladesh

If all eligible individuals pay taxes according to their income tax slabs, revenue collection from personal income tax would rise to 3.1 percent of GDP from just around 1 percent currently, according to a research report.

Direct tax measures can also reduce the growing inequality, says the report.

Research and Policy Integration for Development (RAPID) disclosed the data at a seminar titled “Using Direct Taxation to Tackling Inequality and Boost Revenue” on Saturday. The seminar was jointly organised by RAPID and Economic Reporters Forum (ERF) at the ERF office in Dhaka.

RAPID Chairman Dr Mohammad Abdur Razzaque presented the keynote paper on the studies.

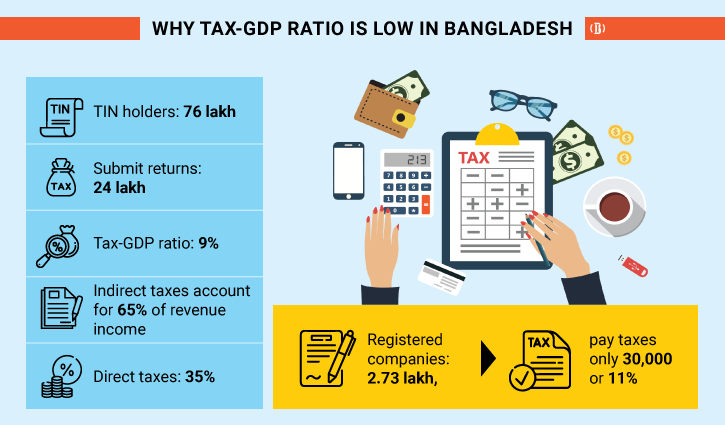

He said Bangladesh’s tax GDP ratio is 9 percent, which is one of the lowest in the world because of low income from direct taxes.

Currently, 65 percent of Bangladesh’s taxes come from indirect measures and 35 percent from direct. However, the government has taken the initiative to increase the share of direct tax to 70 percent and reduce indirect taxes to 30 percent.

He pointed out that inequality and low government spending (budget) as a share of GDP are the major problems in our country.

“If we want to achieve high growth and become a developed country, revenue collection as a proportion of GDP should be increased to 17 percent by 2030 and 21 percent by 2041,” Razzaque said.

And, a significant part of it must come from the direct tax, he added.

The tax identification number (TIN) holders are 76 lakh while only 24 lakh submit annual returns.

Also, Bangladesh’s corporate tax is only 1.4 percent of the GDP. Currently, there are 2.73 lakh registered companies. Of these, only 11 percent or about 30,000 companies pay taxes. Rich people also do not pay surcharge tax as they are obliged to do, RAPD said.

Former Chairman of NBR Nasir Uddin Ahmed said the new target to increase direct tax is an ambitious target. The government should give a time frame to achieve the target, such as raising the share of direct tax to 50 percent.

Due to the political economy, NBR lags behind in boosting revenue income, he said, adding that many sectors are getting tax holidays and special tax rebates. He said many Members of Parliament are businessmen and they want to take advantage of the tax exemption.

Due to these reasons, Tk 2.5 lakh crore of taxes is lost every financial year, according to an NBR study.

Additional Secretary of the Finance Ministry Kabirul Ezdani Khan agreed with the speakers that the amount of the budget is small compared to the GDP. Despite the high revenue potential, the tax-to-GDP ratio is very low, he said.

He also pointed out that, in many areas like real estate and new businesses Facebook, Amazon, Foodpanda and many other businesses on online platforms, the government is losing huge revenue.

To increase revenue income, he suggested that, “A major solution is that tax collection procedure should be automated, establish a taxpayer service wing of NBR and policy reform”.

Rapid Executive Director M Abu Yusuf moderated the seminar and NBR member Mahmudur Rahman, ERF president Sharmeen Rinvy and general secretary S M Rashidul Islam spoke among others.