Finance division likely to take over tax automation job

BI Special || BusinessInsider

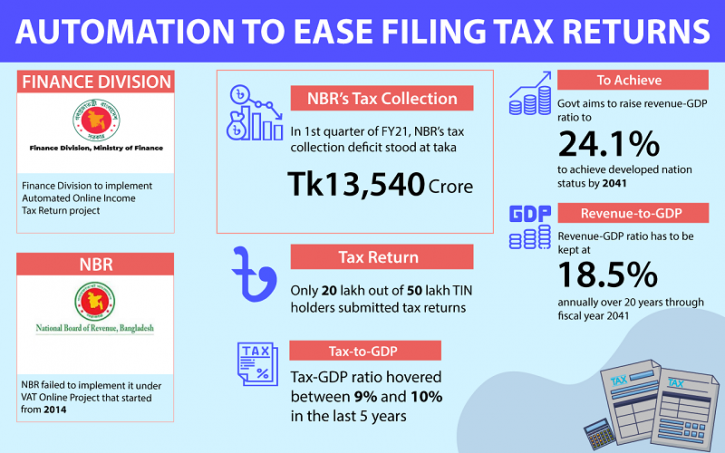

The Finance Division of the Ministry of Finance might take over as the new implementing authority of the Automated Online Income Tax Return project after the failure of the National Board of Revenue (NBR) to put it in place.

Senior Secretary of Internal Resources Division (IRD) and Chairman of NBR Abu Hena Md Rahmatul Muneem has already signed the summary of the Finance Division’s proposal to develop the system.

According to the summary, the Finance Division will form a 10-member committee for developing the system with five members each from the finance and the internal resources divisions.

Senior Secretary of the Finance Division Abdur Rouf Talukder said the country's income tax-to-GDP ratio remains very low compared to the country’s economic development for over a decade. Also, the ratio is very low in Bangladesh compared to other countries.

After introducing the automation of online income tax returns, the county can increase its income tax-GDP ratio along with increasing its revenue collections, Rouf added.

At present, the total number of Tax Identity Number (TIN) holders in Bangladesh is 50 lakh, but only 20 lakh submitted their tax returns in 2019-20 fiscal year.

Following the automation of online income tax returns, more TIN-holders will be encouraged to submit tax returns, according to the summary of the proposal.

The Finance Division has successfully introduced an IT-based National Savings Certificate database and an automated treasury system, which is why the IRD wants to give the responsibility of the Automated Online Income Tax Returns project to it, the IRD official added.

NBR has failed to implement the system under the VAT Online Project that started in 2014, the official further said.

In the first quarter (July-September) of the ongoing 2020-21 fiscal year — until September 25, 2020 — NBR collected Tk41,0187 crore against a Tk58,728 crore estimated target, resulting in a deficit of Tk13,540 crore.

Officials of the Finance Division said that the government has taken an ambitious target to raise the revenue-to-GDP ratio to 24.1% as it aims to achieve a developed nation status by 2041.

However, a General Economics Division (GED) study revealed that this will require the revenue-to-GDP ratio to remain at an average rate of 18.5% annually over the next 20 years to achieve that status.

Bangladesh is one of the least-taxed economies in the developing world as its tax-to-GDP ratio has been hovering between 9% and 10% of the GDP in the last five years.

Dr Reza Kibria, economist and former International Monetary Fund (IMF) adviser, has criticised the businessmen who pressurised the government into aborting the online VAT project.

He also said it is not possible for the NBR to be ambitious in achieving the revenue target this year as it will be difficult to expand the country's internal resources amid Covid-19.

“Tax should not increase without reducing income inequality of people in the country, even if the system is automated,” he said, adding that more taxes should be levied on rich people rather than the poor.