Mitro operates microcredit business illegally, evading regulatory oversight

BI Report, Dhaka || BusinessInsider

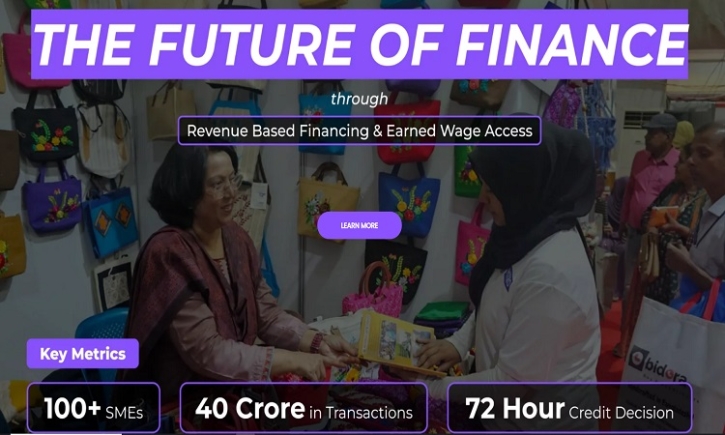

Photo taken from its official website

Mitro, an embedded finance platform, has been conducting its microcredit operations for an extended period without permission from the Microcredit Regulatory Authority (MRA).

Mitro began its journey in 2022 and since then, it has been providing instant credit access to businesses, employees, and vendors to bridge payment gaps, based on the idea of giving every individual the power to control their finances beyond regular banking.

It conducts its microcredit business in collaboration with Samannita Jonokallyan Kendra (SOJON), a digital micro-finance institution that provides access to socially responsible financial services.

Since its inception, Mitro has already partnered with 14 companies in the country and the growth of the microcredit operator is expanding quickly though it has no legal rights to operate such a business.

The MRA is the central body of the government that monitors and supervises the microfinance operations of non-governmental organisations in the country.

It was created by the government under the Microcredit Regulatory Authority Act (Act No. 32 of 2006).

However, it is a matter of grave concern that Mitro is operating its microcredit business without approval from the MRA. Mitro addresses the credit challenges for thousands of individuals and numerous businesses.

Integrated into daily operations, Mitro's solutions like Earned Wage Access, Business Credit, and Digital Deposits have benefited over 50 businesses.

Based in Bangladesh, Mitro aims to revolutionise the financial inclusion, targeting the $2.8 billion credit gap in the country, according to data projected on its official website.

The reporter learned that Mitro operates its microfinance business using Sojon’s license, going beyond the terms and conditions of the MRA.

Furthermore, Mitro has been found noncompliant with the regulatory directives of the Bangladesh Bank, failing to report transaction details, and neglecting VAT and AIT obligations on disbursements and collections.

Mitro also raises funds from general investors with interest rates exceeding 18 percent and uses these funds to support the businesses of friends and families linked to the institution.

Recent reports indicate significant bad debts, including a Tk 5 crore loss in a readymade garment (RMG) venture, potentially impacting investors who are unaware of these risks.

These practices are at odds with central bank policies, specifically the Advance Deposit Ratio (ADR) policy.

The reporter talked to H.M. Asif Imtiaz Alam, head of business at Mitro Fintech, but he refused to respond to the journalist’s queries. The reporter also sent an email with some questions to Asif a week ago, but he has not yet responded.

While talking to the report, Md. Shah Alam, executive vice chairman (Additional Responsibilities) of the Microcredit Regulatory Authority, said no one can run such a business elsewhere in the country without the approval of the authorities concerned.

Claiming that the MRA is the sole authority for overseeing such businesses in the country, the government official said he would go for tough legal action under anti-corruption and money laundering acts against Mitro if it runs its microcredit business without approval.

“Who knows how many people have lost everything falling into the trap of this company? Just give me the address of the company, and I will take legal action immediately against those involved in running such an illegal business,” he said.