BB hikes its policy rate by 25 basis points

BI Report || BusinessInsider

Photo: Collected

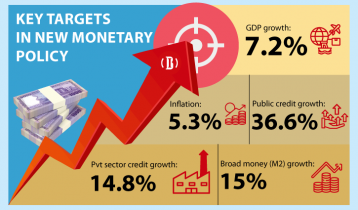

The central bank has raised its policy rate by 25 basis points in its monetary policy for the second half of the ongoing fiscal year

With this, the repo rate jumps to 6 percent from 5.75 percent and the reverse repo rate to 4.25 percent from 4 percent as part of its current policy stance.

Repo is the interest rate at which the central bank loans money to commercial banks.

Also, the lending rate cap for consumers has been relaxed to vary up to 3 percent, along with the complete removal of the deposit floor rate, the Bangladesh bank said in its new monetary policy.

the presence of a suitable economic condition, the removal of the lending rate cap will be considered. These relaxations on the lending rate cap and the complete removal of the deposit floor may help grow the overall deposit rate,” the BB said.

Meanwhile, private sector credit growth remains unchanged at 14.1 percent while the public credit growth ceiling has been increased to 37.7 percent for June from the previous ceiling of 36 percent.

Furthermore, a market-based, flexible, and unified exchange rate regime (within 2 percent variation) will be implemented by the end of this fiscal year.

The BB also has decided to announce its monetary policy on a half-yearly basis from the second half of FY23, which was a regular practice from January 2006-June 2019.