BB unveils cautionary monetary policy to curb inflation and exchange rate

UNB || BusinessInsider

Bangladesh Bank signage. Photo: Collected

Bangladesh Bank (BB) on Sunday announced an accommodative cautionary monetary policy for the second half of the current fiscal year 2022-23 aimed at easing pressure on inflation and exchange rate.

The central bank raised the policy interest rate by 0.25 percent and consumers’ loan rate to 12 percent in order to curb demand lines and inflation.

The new monetary policy keeps untouched a 9 percent interest rate on tern loan (industrial loan) to support desired 6.5 percent economic growth (GDP growth), ensuring the necessary flow of funds to the economy's productive and employment opportunities.

Governor Abdur Rauf Talukdar released the new 'Monetary Policy Statement (MPS)' at Jahangir Alam Conference Hall of Bangladesh Bank on Sunday afternoon. This is his first monetary policy announcement since taking office as governor on July 12, 2022.

While announcing the policy, the governor said that the monetary policy had been made with the aim of curbing inflation by controlling money market flow and interest rate.

In the future, the central bank will work to reduce NPL (non-performing loans) and ensure good governance in the banking sector, he said.

The central bank formulates monetary policy to balance controlling inflation and achieving the desired growth.

Monetary policy is very important in the financial management of the country. Through this, a plan of how much domestic debt, money supply, domestic assets, and foreign wealth will increase or decrease has been presented.

Bangladesh Bank Deputy Governor Ahmed Jamal, Kazi Sayedur Rahman, Abu Farah Md. Nasser, AKM Sajedur Rahman Khan, BFIU Head Masud Biswas, Chief Economist Dr. Habibur Rahman, Executive Director, and Spokesperson Mesbaul Haque, and senior officials of the different departments were present.

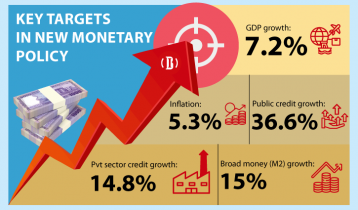

In the second half of the current FY2022-23, the target of credit flow to the private sector has been set at 14.10 percent. It was 14.8 percent in the previous financial year.

However, financing the budget deficit has not reduced public sector borrowing, but increased it by Tk37.70 percent.

The repo rate, considered the policy rate, has been increased by 25 basis points to 6 percent from 5.75 percent to reduce inflationary pressures, as well as to ensure credit supply for investment and employment. It means if the banks take money from the central bank for urgent needs, they will have to pay extra interest.

Besides, the reverse repo has also been increased by 25 basis points from 4 percent to 4.25 percent. Now keeping money in the central bank, banks will earn more interest than before.

Besides, the money supply target has been reduced from 12.10 percent to 11.50 percent.

In the budget of the current fiscal year 2022-23, Finance Minister AHM Mustafa Kamal said that inflation should be kept at 5.6 percent. But at the end of last November, inflation stood at 8.85 percent.

The government will go for bank loans to meet the budget deficit. The government is targeting to take a bank loan of Tk 1.6 lakh crore to meet the budget deficit for the fiscal year 2022-23.

This figure is Tk29882 crore more than the target of the borrowing in this financial year. In the budget of the current financial year, the target of borrowing was Tk76452 crore from the banking system.