Bangladesh Bank sticks to expansionary monetary policy

BI Report || BusinessInsider

Photo illustration: Bangladesh Bank

Bangladesh Bank has decided to continue its pro-growth expansionary and accommodative monetary policy stance in a bid to support the economic recovery amid the ongoing coronavirus pandemic.

The central bank on Thursday unveiled its monetary policy stance for the first half (July-December) of the current fiscal year 2021-22.

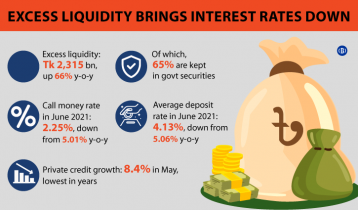

After the pandemic hit the country in March last year, the BB cut repo and reverse repo rate and bank rate to make more funds available for investments. Also, the central bank slashed the cash reserve ratio to give more funds into banks’ hands so that they can lend more money to the affected businesses.

“Relaxations of various policy rates taken last year to mitigate the impact of the coronavirus pandemic will continue this year also,” said Dr Fazle Kabir, governor of Bangladesh Bank, while unveiling the monetary policy.

Last year, the BB slashed repo rate to 4.75 percent, reverse repo rate to 4 percent and cash reserve ratio to 4 percent.

Also, the BB purchased extra government securities from the banks’ holdings for supporting their longer-term liquidity need, introduced various low-cost refinance schemes, allowed loan moratorium facilities and extended time for realising export receipts and import payments, and introduced a new credit guarantee scheme for making easy access to credit at a lower cost by CMSMEs.

The central bank also extended its support in implementing most of the government’s 28 stimulus packages worth Tk 1,35,000 crore taken for the recovery of economic activities disrupted by the Covid-19 pandemic.

The governor said the economy started recovering from the last quarter of 2020, but from March this year economic activities slowed down again due to the second wave of coronavirus.

“Under these circumstances, we have decided to continue with the relaxation policy of interest rates, including CRR. Experts and stakeholders also agreed with the going on with the relaxation,” Kabir said.

However, he sees some silver linings in the economy. These are: strong export and import growth and inflow of inward remittances.

“These trends in international trade and inward remittances are anticipated to continue in the coming months owing to the policy support structures of the government and for a positive turnaround in Bangladesh’s major export destinations including the USA and the Eurozone alongside an expected revival of economic activities in the oil-enriched Middle Eastern countries,” he said.

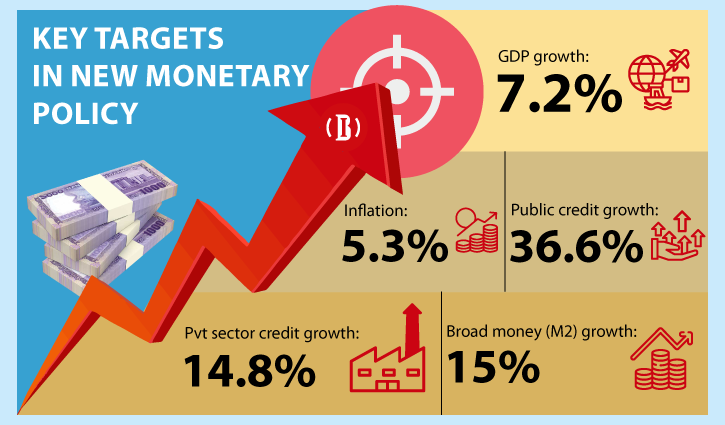

According to the BB, the monetary policy stance has been designed to support the government policies and programmes in pursuit of faster and inclusive economic growth and poverty reduction; while also maintaining price stability.

The BB thinks that the policy stance for the FY22 will help the government achieve a 7.2-percent GDP growth and keep the inflation rate within the target of 5.3 percent. As part of that the central bank set the private sector credit growth target at 14.8 percent, up from 8.4 percent in May.

The ongoing Covid-19 pandemic forced the BB to unveil the half-yearly monetary policy online for the third time in a row.