Rethinking strategy for retail business

Arijit Chakraborti || BusinessInsider

The last six months have been a unique period, not only in the 21st century, but in the history of modern retail businesses. This has been a busy time for behavioural scientists who have been collecting a significant quantum of data points to analyse and develop insights into the rapidly changing behaviour of customers. At the same time, it was a challenging time for retailers.

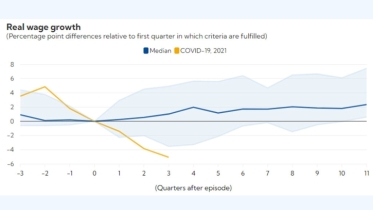

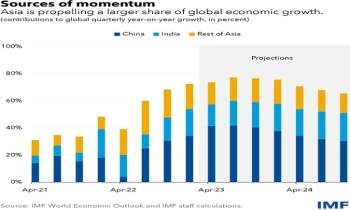

While the root cause of such behavioural changes has been the pandemic, there have been multiple factors driving the rapid change in customers’ behaviour. One major driver is the economy and people’s livelihood. A number of countries across developed and emerging countries have seen a shrinkage of their economies during this period. Simultaneously, a large number of people are moving from the middle-income group to the low income group, and from the low income group to poverty. Such a significant shift in customers’ income is adversely affecting their buying behaviour.

The Global Consumer Insights Survey 2020, conducted by PwC,1 focussed on four key questions to help us understand such rapidly changing behaviour better. The survey collected data from urban consumers before the outbreak of the pandemic and after economic activities were resumed.

The first question was aimed at understanding how robust the market will be for goods and services offered by retailers. To understand this better, PwC analysed the household expenses and incomes of a target group of consumers. According to 41% of urban consumers their household expenses have gone up. These expenses are primarily for food, electricity and include other household expenditure. Due to the lockdown and their restricted movement, many of these consumers spent their days at home and many worked from home like full-time employees. This resulted in higher consumption of household utilities such as electricity, and increased their expenses.

According to 40% of urban consumers, their incomes have dropped, either due to loss of jobs or reduction in salaries. When the lockdown (with restricted movements) was enforced, many organisations scaled back their operations and many temporarily shut down of their operations.

According to about 18% of the consumers, their household expenses have gone up and their incomes have come down. This group of consumers has been affected (economically) the most.

Such changes have reduced consumers’ confidence to a great extent. While their surety about maintaining their usual spending pattern was very high before the pandemic, now more than half of them admit that they will spend less in coming months. Their focus in buying will be more on food items and they will actively reduce their expenditure on non-food products. PwC’s survey indicated that there will be reduced spending on certain categories such as clothing, footwear, outdoor activities, restaurants and beauty products.

Consequently, retail businesses should expect volatility and price sensitivity among their customers and design their business strategies accordingly.

The second question was to understand the experience retailers should offer to attract their customers back.

Urban customers were earlier fairly upbeat about their spending, such as on visits to physical retail stores and outdoor activities such as visiting restaurants. Today, they are cautious about resuming such activities with the same frequency.

According to 49% of the surveyed consumers, they said that they are spending significantly less on fewer social events and activities. For many of them, indoor activities with their family at home have become their mode of recreation. For example, many of them have substituted their weekend dinners at restaurants with cooking at home together with their families.

Among the consumers surveyed, 23% said that they had lost money due to cancelled events. It is understandable that many event organisers did not or could not refund the money to consumers at the onset of the pandemic-triggered lockdown. Some of them delayed the refund process. However, during this period, many consumers have prioritised their health and safety over outdoor activities.

PwC’s survey also indicated that 50% of the consumers are spending more time on social media, and 56% have significantly increased their television watching time. This has created an opportunity for retailers to use these mediums to increase their exposure to their customers.

The key takeaway from the data collected is that the customer experience must be rooted in safety and accessibility. Customers are prioritising their health and safety above all else before committing themselves to certain behaviour, such as visiting retail stores. They also focus on ease of accessing goods and services without worrying about their health and safety. Retailers who can deliver such experiences to their customers are emerging as the winners in this new normal.

The third question related to how retailers should engage with consumers in coming days. The pandemic has accelerated the use of mobile devices for shopping and reduced this practice through physical stores.

According to PwC’s survey, 9% of the consumers earlier shopped for groceries on online shopping websites or mobile apps. After the outbreak of the pandemic, 63% of the respondents said that they are buying their grocery items at online retail stores. More importantly, 86% of such online shoppers expect to continue shopping at online stores in the foreseeable future. If this changed behaviour is going to last long, retailers need to rethink their engagement strategies. Moreover, till recently, young shoppers were comfortable shopping online. Now digital migration of shoppers is taking place across different segments.

More and more consumers are now using Internet-based video or messaging apps on their mobile devices. They are also using high-speed Internet connections, such as 4G mobile data connectivity or fixed line broadband connectivity. Data published by the Bangladesh Telecommunication Regulatory Commission (BTRC)2 indicates that there has been a significant increase in the number of fixed line broadband Internet subscribers in Bangladesh during the last couple of months. So it is clear that consumers are becoming ‘digital savvy’ and prefer a diverse range of engagements with retailers digitally.

The final question was about the experience retailers should offer customers to retain them. The pandemic has disrupted the value hierarchy to a great extent. For example, a well-known restaurant with a wonderful ambience and a celebrity chef could attract customers who also trusted the restaurant to procure good quality raw materials to prepare their meals. A grocery store that was selling high-quality food items to this restaurant would not have any visibility to such customers. In the new normal, such customers are less willing than before to visit well-known restaurant. Instead, they prefer to visit well-stocked retail stores for high-quality food items and cook their meals at home. Retailers can now create value by bringing popular chefs’ recipes to their stores and offering the assortment of products required in the recipes. They can also plan digital engagements for customers, e.g., live interactions with well-known chefs from customers’ homes. Going forward, there are likely to be many such value creation opportunities for retail businesses.

PwC’s survey indicates that customers are now focusing more than before on their well-being, with 69% saying that they are more concerned about their physical and mental health and well-being than anything else; 64% said that they are focussing on their medical needs to keep themselves healthy and safe; 63% indicated that they are more focussed on their diet now than ever before.

Therefore, it is evident that it is important to innovate vigorously to create value for customers and prioritise their health and safety. Customers are likely become advocates of a retail business if the retailer demonstrates that it cares for them and innovates to create value.

The pandemic has taught everyone some critical lessons. Retail businesses need to learn from their experience with customers and transform themselves to be in sync with the new normal. So we can look forward to the sector witnessing interesting times in retailing in coming days.

The writer is a Partner at PwC. The views expressed here are personal.