What steps can be taken to overcome crises of foreign exchange, inflation

Md Kafi Khan || BusinessInsider

Md Kafi Khan. Photo: Collected

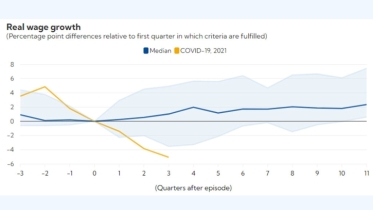

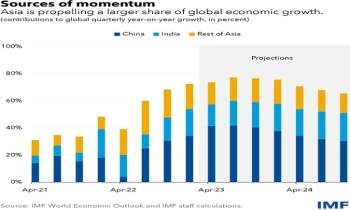

The current crisis began with the Covid-19 pandemic that affected production and import-export- related activities across the world leading to high rates of inflation. As fears of a global recession rose, every economy in the world used stimulus packages or financial assistance to increase its money supply and boost production. The scenario began to improve by the end of 2021 but the Russia-Ukraine war disrupted the supply chains of oil, gas, fertilisers, chemicals, and various other agricultural commodities. 8 This induced further inflation across the world, particularly in the USA, reaching 8.5% in March 2022, the highest since 1981. To tackle inflation, the US Federal Reserve decided to raise interest rates luring investors from across the world. More than 50% of the rise in dollar value can be explained by the Fed’s aggressive monetary policy. Besides, high energy prices have been hitting fuel importers, like most of Europe and the developing world (including Bangladesh), harder than the USA since it is less reliant on oil and gas imports. 9 As a result, most currencies in the world started to lose their value against the dollar. Macroeconomic volatility as a balance of payment (BoP) crisis while the mainstream media prefers the term dollar crisis. Both refer to the effect of rising dollar prices as a result of supply shortage, which, in turn, is a result of a balance of payment deficit (greater imports than exports).

The rise in dollar value primarily affected Bangladesh’s imports and exports. While imports became more expensive, exports should have ideally increased due to competitive prices.

However, the rise in fuel prices increased the costs of production while the domestic inflation rates and contractionary monetary policies in North America and Europe slowed down the demand for most of Bangladesh’s export items, resulting in decreased exports. Imports, on the other hand also increased in volume due to the GoB’s post-Covid-19 stimulus package and the Import Policy

Order 2021-24, which eased import regulation and increased access to duty-free imports. Remittance flows into the country also decreased by 15% in FY22 compared to FY21. Consequently, the fall in exports and rise in import payments led to higher demand for the dollar and a growing balance of payment deficit (with a historically high trade deficit of $33.25 billion in FY2021-22) which had to be covered by foreign exchange reserves. Concurrently, a more expensive dollar and its shortage in the domestic market pushed BB to inject funds from the foreign exchange reserves into the market to stabilise the exchange rate.

The troubles of the banking sector are another issue that has contributed to the balance of payment crisis. In times of crisis, BB relies on local banks to buy dollars. However, the banking system is continuously plagued by a high degree of non-performing loans and challenges to corporate governance in the sector. From 2020 to 2021, non-performing loans increased by 16.38% despite a relaxed loan classification policy. The total amount of non-performing loans stood at Tk 1032.74 billion as of 31 December 2021. Between 2009 and 2018, an average of $8.27 billion was syphoned annually through the mis-invoicing of traded goods. The extent of Swiss bank deposits by Bangladeshis in the past decade is indicative of capital flight. In 2021, such deposits grew by 55%, reaching $912 million.

In addition to large amounts of capital flight, inefficiency and high amounts of subsidies in the annual budget also contributed to the current crisis. The energy sector is a prime example that incurs significant wastage of resources. The contractual obligations (capacity charge provisions) towards the Quick Rental Power Plants (QRPPs), Rental Power Plants, and Independent Power Producers in the private sector force the government to pay these companies even when they do not provide any electricity. Bangladesh’s “managed floating” exchange rate regime is another addition to the problem mix. The taka has been artificially kept higher value for years which has led to the loss of export competitiveness and remittance inflow through the banking channel. The country’s overdependence on the ready-made garment (RMG) sector is also another reason why the dollar volatility has affected the country to such a degree. The RMG sector is heavily dependent on imports for raw materials and the export markets are primarily Europe and North America.

To tackle the crisis, the Government and Central Bank have come up with a range of policy solutions within a three-pronged approach –demand side, supply side, and market control– as elaborated.

While the majority of the policies are targeted to increase the supply of dollars in the domestic market, some are designed to reduce the demand and effectively implement the supply side policies by controlling the market. However, such an influx of funds, although necessary at the moment, puts Bangladesh at risk of falling into a debt trap.

Ways forward may think about:

Contractionary Monetary Policy: One of the most effective ways of controlling inflation is using monetary policy. Over the last year, countries across the world have increased their interest rates as it influences several economic indicators including inflation, balance of payments, and exchange rate. However, the plans to increase the money supply in FY23 which will be counterproductive in reducing the inflation rate. At present the real effective interest rate in Bangladesh is negative. BB should consider increasing the interest rate and reducing the money supply to control demand-pull inflation. It will also induce a rise in treasury funds (via increased savings) enabling it to tackle short-term expenditures. To balance the higher cost of financing for export-oriented industries and tackle the threat of layoffs in labour-intensive sectors, it may take alternative measures like short-term tax holidays or industry-specific incentives while nudging= underperforming businesses to increase efficiency.

Floating Exchange Rate: The taka, in theory, is a free-floating currency but in reality, it is a pegged/managed floating one, also known as a “dirty float”. The ongoing economic crisis has exacerbated this pressure which now needs an effective outlet. Over the next several months, the regulator may gradually move towards a floating exchange rate by periodically depreciating the taka. If the taka value plummets fast, it would also encourage remittance inflow through the formal banking channels reducing the incentives for hundi and other illegal transfers.

July 2022 statistics showed a good picture since it marked the highest inflow of remittance in the past 14 months. The increase in imported raw material costs is already being cushioned by the interest rate cap on import LCs. However, since continued market surveillance is not sustainable in the longer run, moving towards a floating exchange rate would be the best possible option for Bangladesh.

Contractionary Fiscal Policy: The next option to raise corporate taxes to increase its fiscal capacity which will be necessary given the depreciation of the taka. Such a move might displease corporates and put excess pressure on businesses but the progressive structure of our taxation system enables Bangladesh to raise the rates at the upper end. The higher tax rates could be implemented for a transitionary period of 2 to 3 years enabling the government to absorb the current economic pressure and have an anti-inflationary impact on the economy. Bangladesh should also strengthen its tax collection strategies and clamp down on tax evaders, a process that is ongoing. But it would also mean tightening the taxation policy for not just the middle-income groups but also for large-scale tax evaders. A strong anti-graft policy could go hand-in-hand with the overhaul of the taxation strategy but it would depend solely on the effective implementation of the policies.Controlling Import Dependence for Essential Goods and plan to develop infrastructure modernization of agriculture sector to produce required agri-products: The current crisis has brought to attention that Bangladesh needs to reduce import dependence to improve its food security and energy capacity. Food imports account for approximately 9% of the total imports while oil and petroleum account for 11%. Bangladesh produces large quantities of rice each year and yet it needs to import rice and wheat (worth $176.1 million in FY21) along with essential items like edible oil (worth $186.8 million in FY21). At present, the country exports vegetables and fisheries items but it should also focus on improving the production of staple items to hedge the risk of food insecurity. One particular measure could involve reducing the collateral requirement for farmers accessing loans. Interest rates could also be differentiated for essential and non-essential food products. In terms of energy capacity, in the past 11 years, the trend has been inclined towards importing expensive LNG rather than exploring natural gas reserves. According to Bangladesh Oil, Gas and Mineral Corporation (Petrobangla), the country has gas reserves for 9 to 10 years, assuming consumption of around 1 trillion cubic feet (TCF) every year.49 Out of the 29.9 TCF reserves in our 28 discovered gas fields, 19.11 TCF has already been extracted. Since there is a race against time, Bangladesh should act fast by overhauling the existing wells to increase production while looking for new reserves. It should also focus on scaling up the utilisation of green energy, particularly solar power, learning from the success stories of 6 million solar home systems.

Needed Export Diversification and introduce PPP for agri-revolution: Policymakers in Bangladesh have discussed export diversification for more than 20 years. In reality, Bangladesh’s export revenue still relies on the RMG (85%) which is heavily dependent on raw-material imports (80%). Moreover, the RMG export markets are also narrow and constrained by tariff and non-tariff barriers. On the other hand, Production, processing and marketing in agriculture are dynamic in nature due to continuous change in consumer’s demand and expectation. An innovative approach is essential to meet the current challenges of agriculture. Agriculture in the current competitive environment needs more focus to improve the quality and quantity of produce. Global climate change and land and water scarcity are emerging as the major challenges to agricultural sustainability, which need to be addressed through multidisciplinary and multi-institutional efforts with use of cutting edge technologies and forging partnerships across institutions and sectors. Bangladesh needs to make the tough calls with its long-term strategy in mind instead of focusing on quick fixes. And the dollar crisis presents that opportunity by being a sanctification in camouflage, jolting the country in the right path.

Md Kafi Khan is Company Secretary, The City Bank Limited