Robi’s profit dips 33.4% in Q3

BI Report || BusinessInsider

Robi

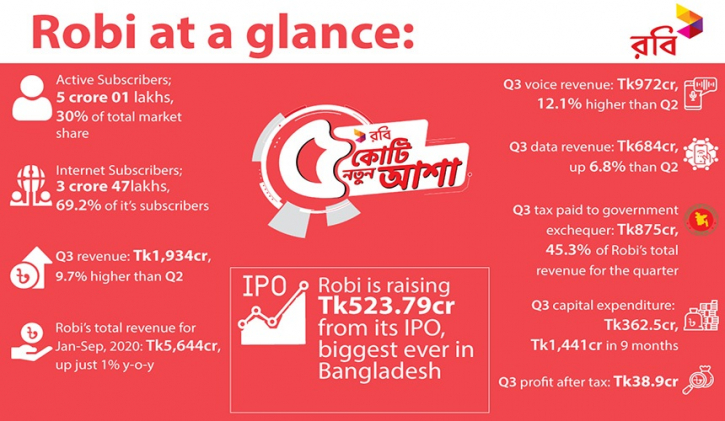

When Robi began to raise money through the country’s biggest ever initial public offering (IPO), the mobile operator has come up with a shocking piece of news that its profit declined 33.4% in the third quarter of the year.

In Q2 of this year, Robi’s profit after tax was Tk58.4 crore which came down to Tk38.9 crore in Q3.

The country’s second biggest mobile operator blamed the profit slump on high taxes.

Had it not been for the crushing 2% minimum turnover tax, this profit figure would have looked far more appealing, Robi said in a statement on Thursday.

“The excessively high taxation regime continues to undermine our performance, with minimum 2% turnover tax casting the darkest spell on our business,” said Mahtab Uddin Ahmed, Robi’s managing director and chief executive officer (CEO).

“We hope that the government will allow us more fiscal headroom by addressing this stumbling block, so that we can share the fruits of improved performance with our new shareholders following the stock market listing.”

Robi’s total revenue for the third quarter was Tk1,934 crore and active subscriber base reached at 5.01 crore, representing 30% of the market share.

Robi’s voice revenue saw double digit growth of 12.1% compared to the previous quarter, reaching Tk972 crore in Q3’20. On the other hand, data revenue reached Tk684 crore in Q3’20 – up by 6.8% from the previous quarter.

Although Robi registered 9.7% revenue growth compared to last quarter, the company’s EBITDA and profit after tax declined by 10.7% and 33.4% respectively from last quarter, largely due to focused drive to acquire subscribers and accelerated roll-out of additional sites which had slowed down significantly during the lockdown situation in Q2’20.

Robi launched the biggest IPO of Tk523.8 crore in the stock market suppressing the previous Grameenphone IPO of Tk486.1 crore. Robi received IPO applications from Nov 17 to Nov 23.

Robi will offload 52.4 crore shares, which are about 10 percent of its stakes, for Tk10 each under the fixed price method.

“On the backdrop of our imminent entry into the country’s stock markets, we are very happy to maintain profitability in Q3’20 supported by enviable revenue growth,” said the Robi CEO, adding: “The most heartening part of our performance is the growing impact of our continued focus on analytics driven innovative initiatives.”

Robi Axiata is a joint venture between Axiata Group Berhad of Malaysia and Bharti Airtel of India. Axiata holds 68.7 percent controlling stake in the entity, and Bharti holds the remaining 31.3 percent share in the company.