Export diversification: How serious Bangladesh is

Kayes Mohammad Sohel || BusinessInsider

Much has been spoken about export diversification for more than two decades, but most benefits have been given to RMG industry

Much has been spoken about export diversification for more than two decades, but the benefits, be it incentive or tax, have been given to the apparel industry.

Naturally, entrepreneurs poured their money into the sector and made it the world’s second largest exporter after China.

Export concentration on garments makes the economy, jobs, and income extremely vulnerable to external shocks arising from changes in global demand for apparel. This has recently been reflected during the Covid-19 pandemic.

More than 3 lakh RMG workers became unemployed during the pandemic in Bangladesh, according to a report of the Bangladesh Institute of Labour Studies (BILS). Around 1,900 RMG factories were shut down or their workers were laid off during the time.

Why garments can and other sectors cannot?

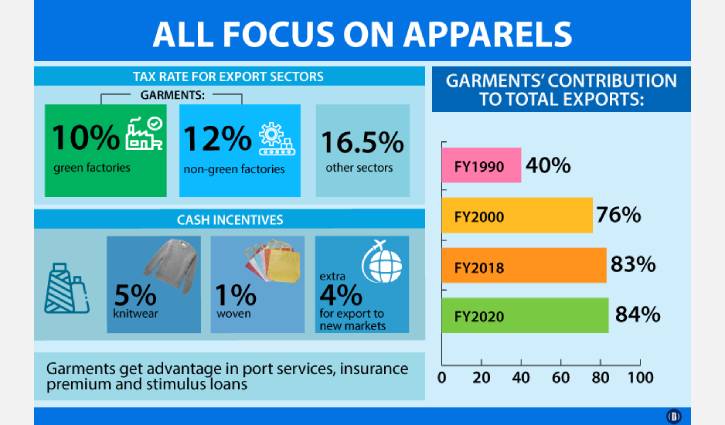

At present, export-oriented garment factories have to pay 12% as corporate tax, while it is 10% for green garment factories. But other export-oriented sectors have to pay 16.5% tax.

Garment exporters have been getting subsidies since its inception nearly four decades ago. Initially, they used to get a 25% cash incentive against their exports. It has come down gradually and now knitwear exporters get 5% and woven 1% incentive. Additional 4% will be added against exports in non-traditional markets.

That is not the end. Garment exporters pay much less insurance premiums than other export-oriented sectors pay. They also get priority at the ports.

Last but not the least garment exporters got more privileges from the stimulus packages the government gave to fight the Covid-19 pandemic than any other export sectors. In phases, the government has given them Tk10,000 crore to pay off their workers. No other sectors got it.

So, why will businesses invest in other sectors when the garment sector gets most of the focus and benefits as well?

Exactly, five years ago — on March 6, 2016, Prime Minister Sheikh Hasina said that jute and jute goods will now be considered as agro-based products. She did so because she had thought that this foreign currency-earning sector could get all the benefits that other agro-based items get.

But that did not happen yet after five years.

On Jan 1, 2020 Prime Minister Sheikh Hasina declared ‘Light Engineering’ as the product of the year aiming to pay special attention to this sector so that it can earn more foreign currency by exporting various products.

Bicycles can be a major export sector as the demand for it is rising in Europe and America due to the coronavirus pandemic. A few companies are exporting bicycles from Bangladesh competing with mighty China, Taiwan, Cambodia and India.

Bicycle exporters are demanding for a cash incentive for years, but they are not getting it. Recently, the commerce ministry recommended providing them some subsidy, but the finance ministry has rejected it.

But, it is not that only cash incentives or subsidies can boost export.

For example, in 2016, then Commerce Minister Tofail Ahmed had said the government set a $5 billion export target of leather and leather goods by 2021. Now, the export earnings from the leather sector are still below $1 billion despite a 10% cash incentive on leather goods to be made in Savar Industrial Park.

Similarly, pharmaceutical makers had said 15 years ago that they would be able to earn $1 billion from export in several years, but still it remains within $150 million.

So, what should Bangladesh do?

If one takes a closer look at the statistics, it can easily be figured out that the country’s export basket has been highly persisting on the RMG, and the diversification efforts over the past few decades have been deemed to be slower.

Garment exports accounted for 40% of the country’s total exports in fiscal 1989-1990, it rose to 76% after 10 years, 83% in 2017-2018, and 84% now.

While fiscal 2017-18’s export data reveals that Bangladesh currently exports more than 200 types of apparel, its export basket comprises upwards of 1,200-1,400 distinct non-garment tradable products that have been exported to nearly 200 countries since 2005.

That looks promising, but 75 percent of these non-garment products are still fetching less than $1 billion, meaning that they started small and are failing to become significant in the export basket.

Analysts say that Bangladesh does not have a competitive advantage in numerous products but something is keeping the exporters from exploiting that competitive advantage in the global market.

“To come out of the export concentration, Bangladesh should move forward logically,” said Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue.

“Financial and logistic benefits for exporters should be given out following the analysis of economic benefits,” he said.

At present, there is no impact analysis about the real contribution of the government support for enhancing export competitiveness and diversification, said Moazzem.

Thrust sectors need to be picked up to promote them with all sorts of incentives so that they will flourish like garments in the future.