Global economic uncertainty remains elevated, weighing on growth

IMF Blog || BusinessInsider

IMF Blog’s Chart of the Week

The shocks that have shaken the global economy in recent years have introduced a new normal for turbulence, driven in some cases by political fragmentation between countries. These episodes have also lifted uncertainty to exceptionally high levels, which in turn hurts economic growth as our research shows.

To better track the evolution of these conditions, we updated our World Uncertainty Index to show more frequent readings that are monthly, instead of quarterly, and incorporate data for 71 economies dating back to 2008.

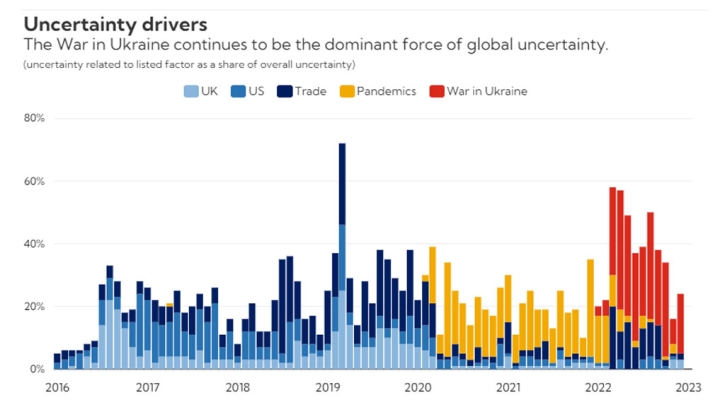

As the Chart of the Week shows, the index fell in December, the most recent reading, but has continued to hit elevated levels in recent times on the back of successive shocks, including most recently Russia’s invasion of Ukraine and the associated cost-of-living crisis.

Our approach uses a text analysis of reports by the Economist Intelligence Unit that allows us to classify the sources of uncertainty by analyzing which words have been published in close proximity to mentions of uncertainty. We believe it’s the first effort to construct a text-based monthly measure of uncertainty covering many developing countries and being comparable across countries.

The interactive chart’s second slide breaks down the composition of uncertainty mentions linked to trade, the pandemic, spillovers from major economies, and Russia’s war in Ukraine.

This shows how the drivers have evolved. Uncertainty jumped following the United Kingdom’s unexpected vote to leave the European Union—and soared even further after the surprise outcome of the 2016 presidential election in the United States. This was followed by US trade tensions with China, which caused major uncertainty for the world.

Another big spike followed in early 2020 with the onset of the coronavirus pandemic, followed less than two years later by another shock from Russia’s invasion of Ukraine and renewed trade uncertainty associated with the risk of geoeconomic fragmentation.